Treasure

Introduction

Treasure is a leading financial technology company that provides professionally managed cash management and embedded investment services via its proprietary API. With the Treasure API, companies can seamlessly embed a complete suite of managed investment and cash management offerings into their own platforms.

Unit can help connect you with the Treasure team. Contact your Customer Success Manager for more information.

B2B cash management

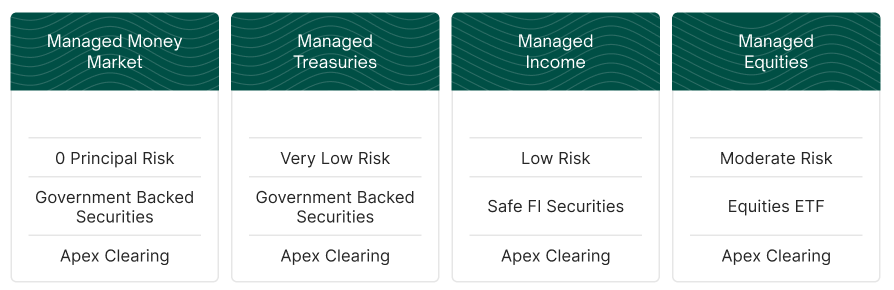

The Treasure API provides professionally managed investments such as Money Market, Treasury Bills, and Fixed Income. These help enable enhanced yield and security for your business clients.

Benefits

Integrating the Treasure API provides many benefits both for your company and your customers.

Benefits to you

With the Treasure API, you can:

- Launch a new financial product in a matter of weeks without sacrificing quality

- Add a new revenue stream that diversifies your business model

- Create a more competitive offering for your customers by increasing your customer’s share of wallet

- Drive higher retention and new growth

- Benefits to your customers

Benefits to your customers

With this integration, your customers can:

- Get access to professionally-managed investments on par with Fortune 500 company Treasury departments

- Access your new product in a seamless way through your existing platform

- Optimize the yield and returns on their idle cash and savings

How the Treasure API works

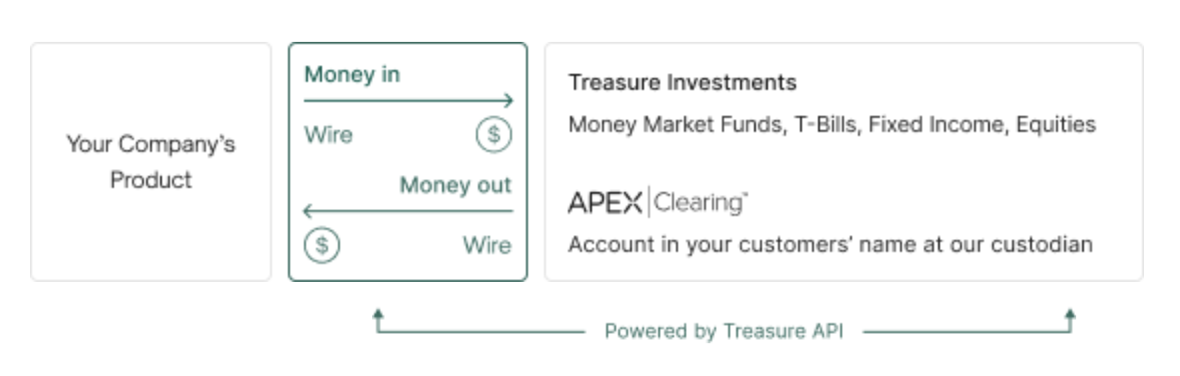

Treasure API provides you with a turnkey solution to embed a professionally managed investment product on your platform.

Account Creation. Onboard a business and create a brokerage account with this API. Know Your Business (KYB) checks are run for you.

Portfolio Investments. Create personalized investment portfolios that are actively managed by world-class investors.

Reporting. Access the insights you need to evaluate investment performance over time.

Fund Transfers. Connect bank accounts and transfer funds.

Portfolio Management. Allow Treasure to handle the trading, rebalancing, and optimization of investment portfolios for you.

- Compliance. Ensure regulatory compliance is handled by professionals. Treasure covers all bases as an SEC-registered investment adviser and is SOC-2 certified. Treasure’s custodian partner, Apex, is an SIPC-insured entity.

Customer experience

Your customers may begin onboarding from within your platform. At most, this process may consist of a handful of questions to create their investment account.

Via the Treasure API, your customers will be able to move funds in and out of the Treasure Investment product. The Treasure API offers a rich set of data that your customers can review on your platform. These data points include a breakdown of their portfolio, monthly returns, and a historical transaction list.

Implementation

User experience

Your team is responsible for creating the end-customer experience. However, the Treasure team can serve as a consultant sharing learnings based on years of serving hundreds of customers.

The user flow will need to have the following components:

Onboarding. In order to open the investment accounts, customers must share specific information for KYB verification. If you already collect some of the same data, you can pass it through the API and shorten the onboarding flow.

Money Movement. Customers will need a way to move money in and out of their investment account.

Portfolio set up. Depending on the level of personalization that you want to enable, your customers may need a way to decide how their funds will be spread between the different financial products.

Dashboard. Your customers will need an experience that showcases the composition of their portfolios and how their investments are performing each month. They’ll also need access to tax documents and trade confirmations.

Backend integration

Learn more about the backend integration.

Integration steps

Access to sandbox. First, Treasure will share access to their sandbox.

Implementation. Next, the Treasure team can serve as a consultant to help answer any questions and guide your team through the user experience, if requested. Treasure collaborates using Slack and weekly check-in meetings.

Certification. After the implementation is complete, Treasure utilizes a two-step certification process that ensures the API is integrated correctly and that, from a compliance perspective, there are no red flags.

Access to production keys. Once the certification process is complete, Treasure shares the production keys and is ready to launch.

Go live. Treasure continues to provide weekly check-ins at the beginning of the go-live period and is available for real-time support via Slack. Treasure will monitor their usage dashboard and error alerts closely during this time.

Investment advisory services offered by Treasure Investment Management, LLC (“Treasure”), an investment adviser registered with the U.S. Securities and Exchange Commission ("SEC"). For important information and disclosures related to the services we provide, please see our Form ADV Brochure. Brokerage services are provided by Apex Clearing Corporation ("Apex"), member FINRA/SIPC. Investing involves risk, including loss of principal. Past performance is not a guarantee of future returns.