Learn how invoice factoring can help solve your customers’ cash flow challenges—and how it generates revenue for your business.

Last updated:

March 22, 2024

7 minutes

Two out of five American small businesses struggle with cash flow, according to Intuit.

For these businesses, the stakes couldn’t be higher. In fact, half of all small businesses fail within their first five years—many because they fail to manage the timing of income and expenses.

Fortunately, if you are a platform that has visibility into your customers’ invoices, you’re in a great position to help your customers smooth uneven cash flow.

In many industries, it’s common to wait 30–90 days to get paid. But when businesses factor their invoices, they can access those funds right away. By providing invoice factoring to your customers, you can increase average revenue per user and stand out from the competition, driving acquisition and retention.

“Invoice factoring can be especially valuable for businesses that struggle to access credit,” says Chuck Stoops, General Counsel at Tradeshift. “It’s a cost-effective way for them to get the funds they need—and might not be able to get, otherwise.”

If you’re a leader at a tech company that serves businesses, this guide is for you. In it, we’ll cover:

Invoice factoring is a type of embedded financing in which your customers receive funds right away by selling you the right to collect payment on an invoice.

It’s a good fit for platforms that have visibility into or help manage their customers’ invoices, orders, and future payments. Examples include Supply Chain and Logistics (e.g., OTR Solutions), Professional Services (e.g., Invoice2go) and Construction Management (e.g., Procore).

To show how invoice factoring works, let’s say you’re the VP of Product at Alcove, a platform that connects general contractors with businesses seeking construction services.

While it’s possible for your customers to use an external provider to factor their invoices, there are key advantages to doing it through your platform:

Invoice factoring isn’t just valuable for your customers—it can also boost your business. With invoice factoring, you can:

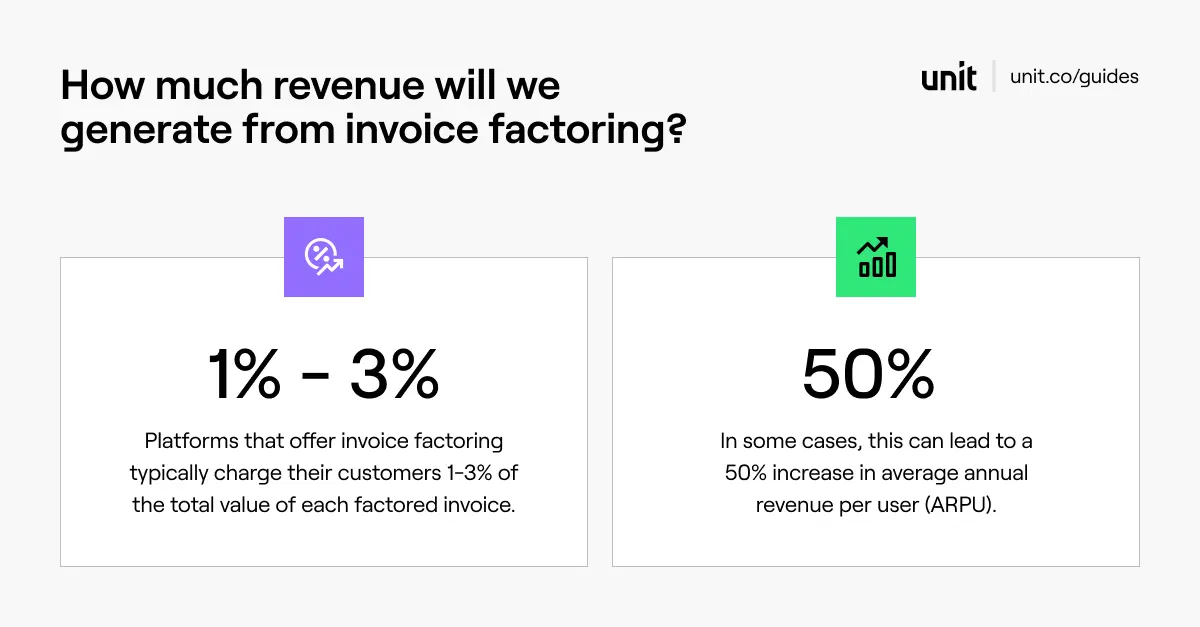

To demonstrate how invoice factoring can lead to a 50% increase in average revenue per user (ARPU), let’s return to our example. Remember, you’re the VP of Product at Alcove, a platform that connects general contractors with businesses seeking construction services.

Let’s assume you charge your customers (e.g., Troy’s Construction) $50 per month for access to your platform. Let’s assume your average customer sends $10K worth of invoices per month. If you’re able to factor 25% of those invoices ($2.5K per month, per customer) and take 1% as revenue ($25), then you’ve achieved a 50% increase in average revenue per user (ARPU).

Unit is a financial infrastructure platform. That means we help tech companies offer embedded bank accounts, cards, lending, and money movement to their customers.

Platforms like yours choose to launch invoice factoring with us because it’s low-friction and fast. If you’re ready to launch invoice factoring, we can help with the following:

Interested in learning more about how invoice factoring could work for your company? Start a conversation with us; you can also check out our sandbox and build in minutes.

Originally published:

October 18, 2023

Frequently asked questions

Account receivables factoring is a type of financing in which your customer sells you the right to collect the money owed from invoices that are due to be paid by their customers.

Account receivables factoring is synonymous with invoice factoring. The terms are used interchangeably and refer to the same process.

There are many ways to launch invoice factoring—but only embedded finance transforms it from a cost center into a revenue generator.

For example, because Outgo (a financial platform for freight carriers) uses embedded finance to offer factoring, they can offer these additional benefits:

To enable invoice factoring, simply follow these steps:

Check out our guides page to learn more about embedded finance