Interest

Overview

Based on the terms between you, Unit and the bank you are partnered with, you may be entitled to be paid interest for the total amount of funds deposited into your Reserve, Revenue and end customers' accounts. You may share that interest with your end customers, or claim it as revenue. Whatever your decision is, it must be properly disclosed and specified in your end customer terms.

Unit makes the necessary interest calculations for you and distributes the interest once a month, in accordance with the terms that are defined in your legal contracts and set in the your deposit products.

Calculating Interest

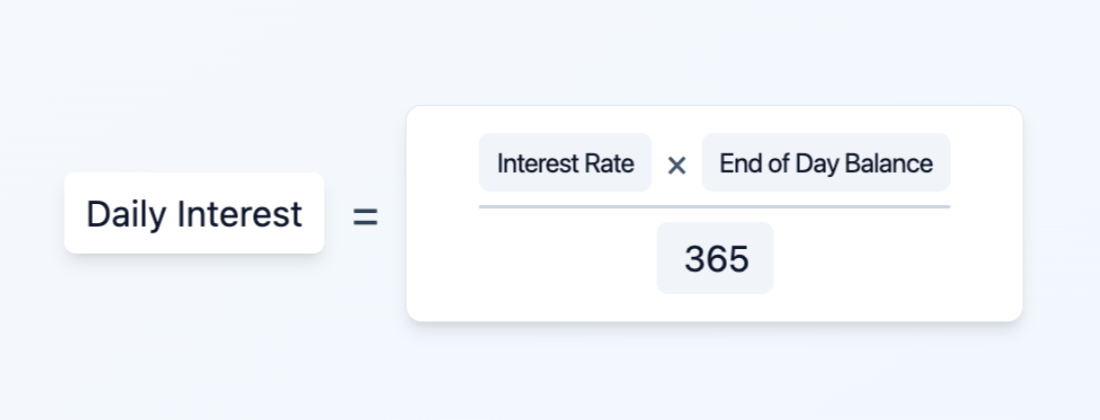

Unit uses the Daily Balance method to calculate interest. This means that interest is calculated and accrued daily based on the end of day balance, but is paid once a month:

The annual percentage yield (APY) is the actual rate of interest earned, taking into account the effect of compounding interest. The APY is calculated in the following manner:

Only accounts in a positive balance accrue interest

Interest Payment

At the 1st of each month the interest will be paid out. It will be distributed between your revenue account, your customers deposit account and Unit, according to your contract terms. For your customers, an Interest Transaction will be created, and a transaction.created events will be fired. In your revenue account an InterestShare transaction will be created.

The Interest section of the monthly statement specifies the total interest earned this month, the number of days in the month and the Annual percentage yield earned.

Note that the interest transaction is only created on 1st of the following month, and so will appear on the consecutive statement (e.g. May's interest transaction will appear on June's statement, while the Interest section of that statement specifies the interest that was accrued in June and will be paid on July 1st).

Interest Calculation Modes

Unit supports three different modes for calculating customer interest on deposit accounts. These modes determine how interest is calculated and distributed between the customer and the organization (client).

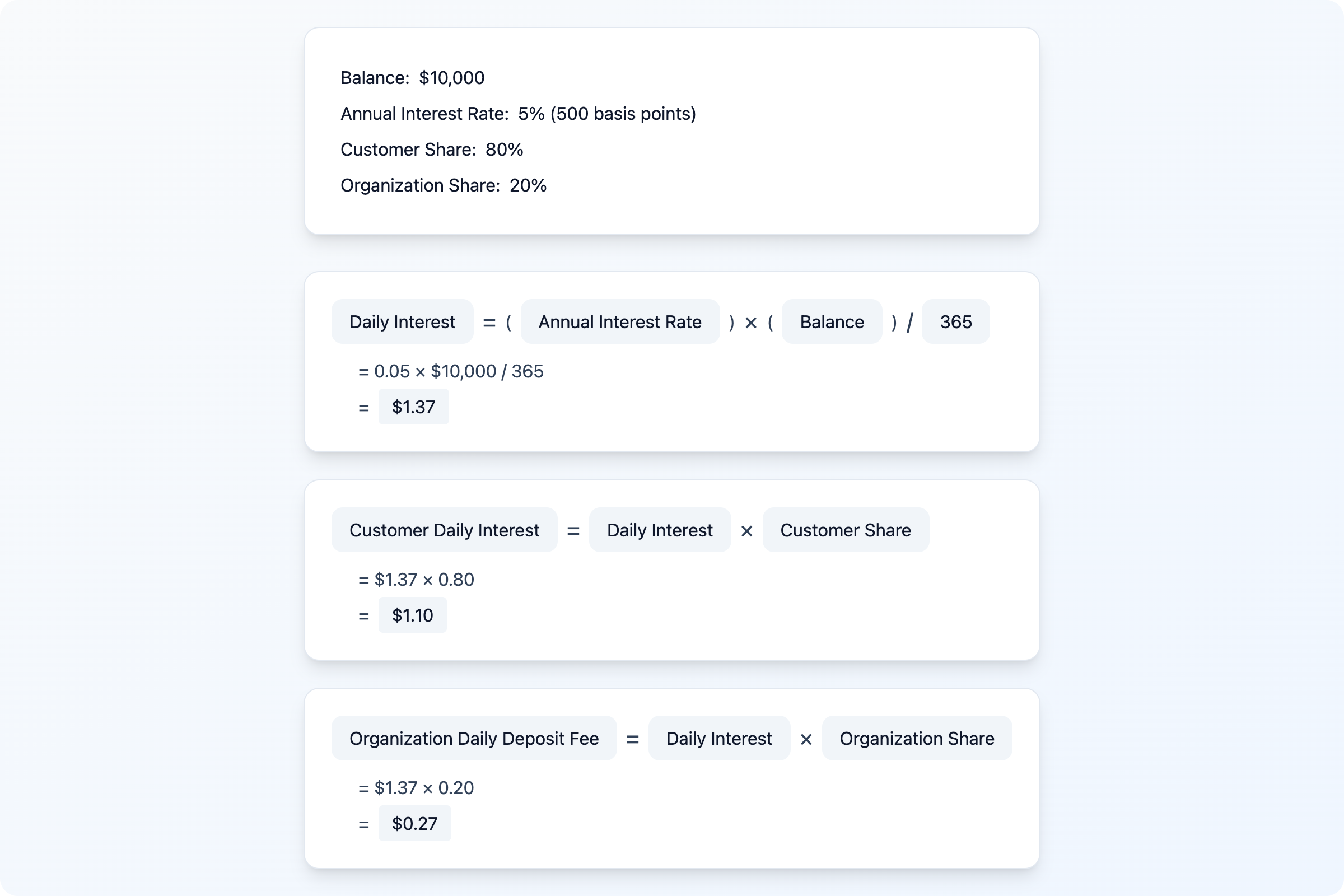

1. Proportional Mode

In Proportional mode, interest is calculated based on a proportional share between the customer and the organization.

How it works:

- An annual interest rate is determined using an interest formula (which may reference Federal Reserve rates)

- The total interest earned on an account balance is split according to predefined percentage shares

- The customer receives their percentage share, and the organization receives the remaining share

Example:

2. Non-Proportional Modes

In non-proportional modes, customer interest is calculated using custom formulas independent of share percentages. The organization receives the difference between the total interest earned and what is paid to the customer.

Non-proportional interest modes require prior Bank approval before they can be enabled.

The system includes a safeguard to prevent the organization from receiving negative interest. If the customer interest calculated from a custom formula exceeds the total interest earned, the system adjusts the calculation to ensure the organization receives zero interest (rather than negative) in such edge cases.

Examples:

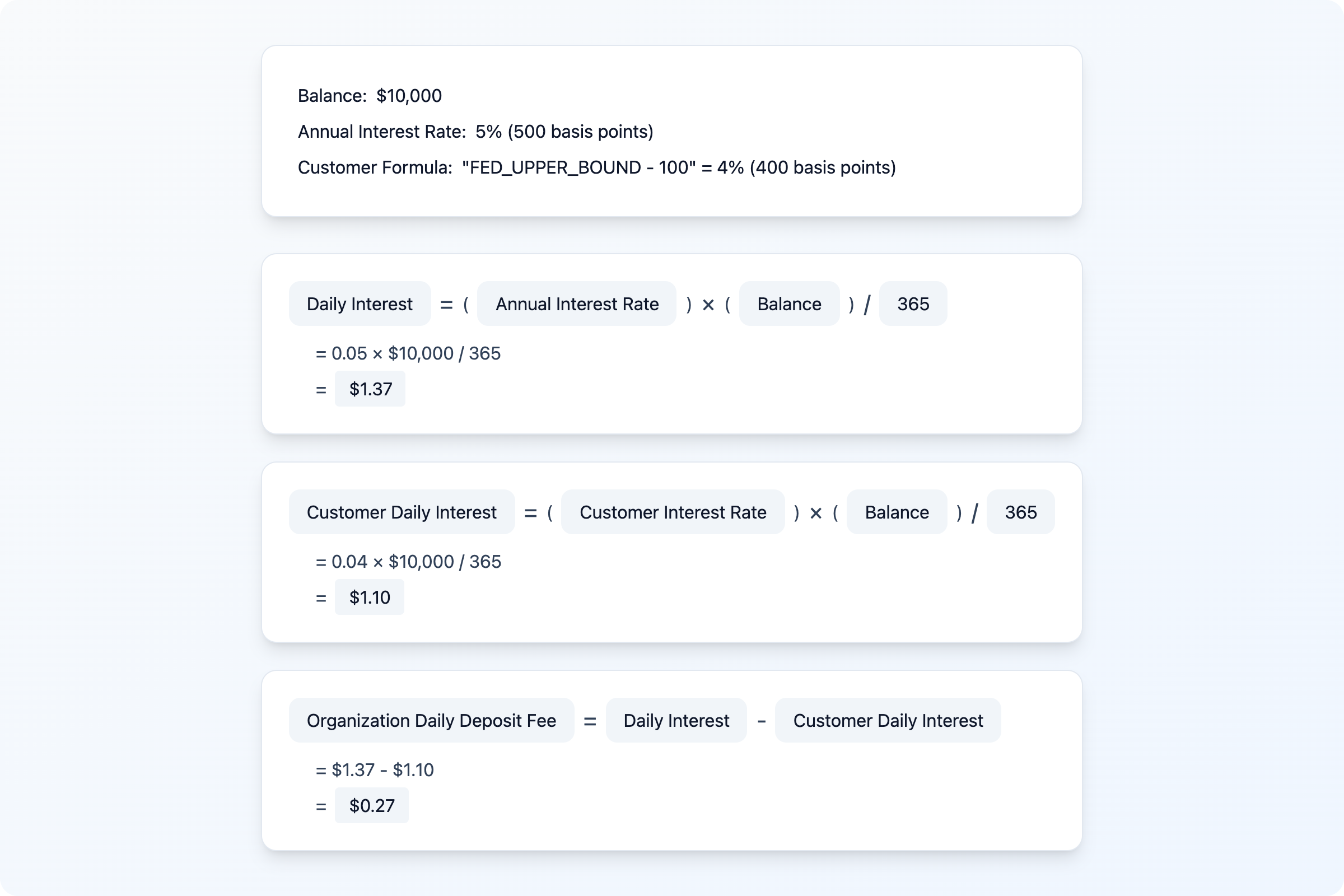

If customer interest formula ≤ total interest earned:

- Total interest earned: $1.37, Customer interest formula: $1.10

- Customer gets: $1.10

- Organization gets: $1.37 - $1.10 = $0.27

If customer interest formula > total interest earned:

- Total interest earned: $1.37, Customer interest formula: $1.50

- Customer gets: $1.37

- Organization gets: $1.37 - $1.37 = $0.00

2.1 Customer Formula Mode

The client defines a custom formula to calculate the customer's interest rate directly, without considering the customer/org share split.

How it works:

- A custom formula is evaluated to determine the customer's interest rate

- This formula can reference Federal Reserve rates (e.g.,

FED_UPPER_BOUND - 50would be 50 basis points below the Fed upper bound rate) - The customer receives interest calculated using this formula

- The organization receives the remainder of the total interest

Example:

2.2 Tiered Customer Formula Mode

Similar to Customer Formula mode, but allows different formulas for different balance tiers. This enables progressive interest rates based on account balance ranges.

How it works:

- Define multiple tiers, each with:

- A balance range (lower bound and optional upper bound)

- An interest formula for that tier

- Choose a tiering mode (Blended or Whole)

- Customer interest is calculated based on the tiering mode

- Organization receives the remainder

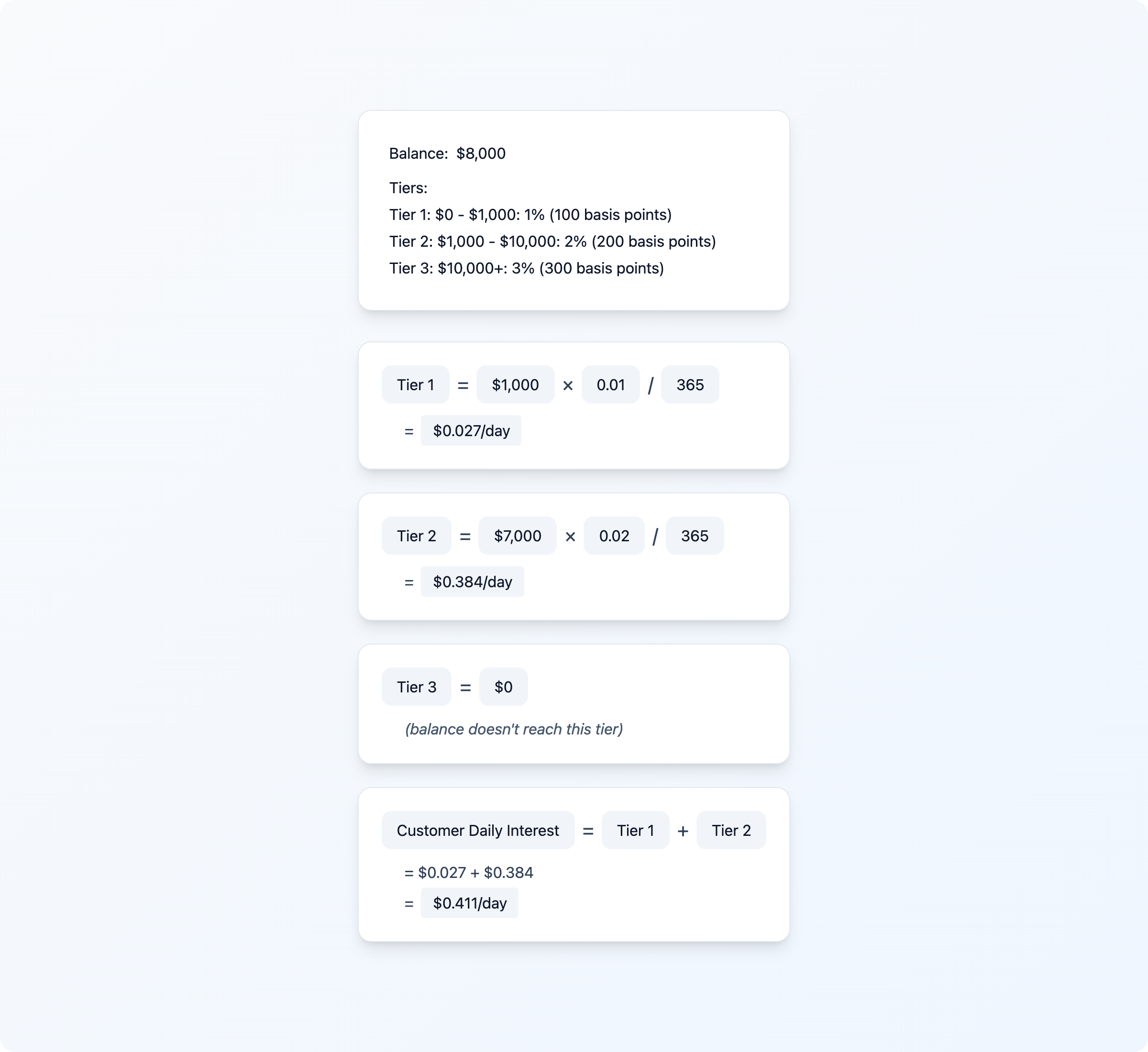

2.2.1 Blended Tiering Mode

In Blended mode, the account balance is split across tiers, and each portion earns interest at its tier's rate. The total customer interest is the sum of interest from all applicable tiers.

Example:

Use case: Incentivizing customers to maintain higher balances by offering progressively higher rates on each tier.

Edge case: If the balance exceeds all bounded tiers in a fully bounded structure, interest is only calculated on the defined tier ranges, not on the excess balance.

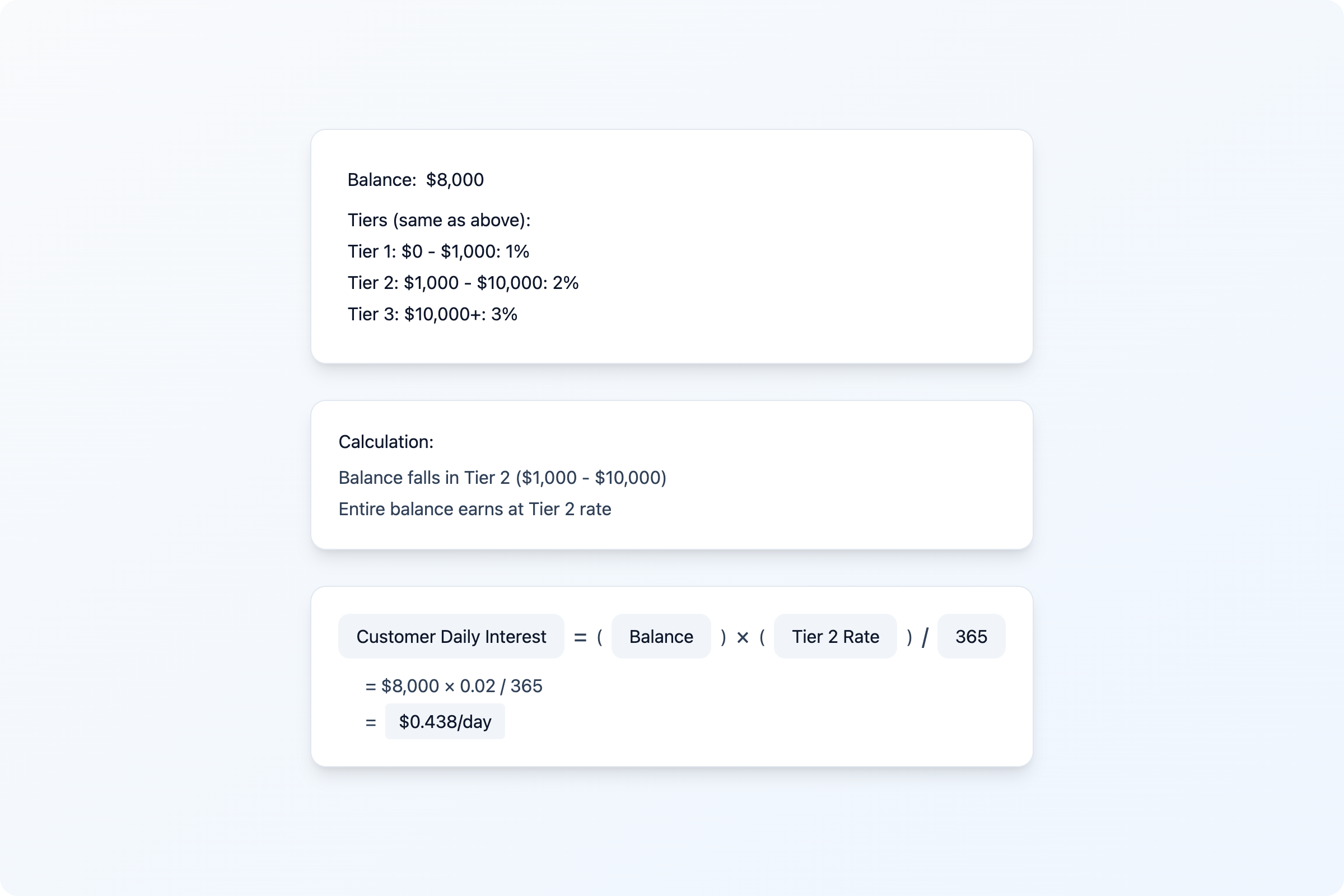

2.2.2 Whole Tiering Mode

In Whole mode, the system identifies which tier contains the balance and applies that entire tier's rate to the full balance.

Example:

Use case: Encouraging customers to reach specific balance thresholds to unlock higher rates on their entire balance.

Edge cases:

- If the balance falls exactly on a tier boundary, the first matching tier is selected

- If the balance exceeds all bounded tiers or falls below the lowest tier, no interest is accrued

- If the balance is just above a boundary (e.g., $1,000.01), it falls into the next tier

Summary Comparison

| Mode | Customer Interest Calculation | Organization Deposit Fee | Use Case |

|---|---|---|---|

| Proportional | Proportional share of total interest | Proportional share of total interest | Simple, predictable sharing |

| Customer Formula | Custom formula (fixed or Fed-based) | Remainder after customer | Competitive fixed rates |

| Tiered (Blended) | Sum of interest across tier portions | Remainder after customer | Progressive rewards |

| Tiered (Whole) | Single tier rate on full balance | Remainder after customer | Threshold incentives |

Technical Implementation Notes

- Interest is accrued daily but paid monthly

- Federal Reserve rate references (

FED_UPPER_BOUND,FED_LOWER_BOUND) can be used in formulas - Only accounts with positive balances accrue interest