Business Charge Cards

What is a charge card?

Charge cards are a type of credit card. They have a credit limit and a fixed repayment cycle, and the customers that received the credit must pay the balance in full at the end of every repayment period. Customers cannot carry a balance between repayment periods, and therefore there is no Annual Percentage Rate (APR), or interest charged.

The full functionality Unit offers on debit cards is available on business charge cards as well, including physical and virtual cards & cardholders, custom card designs, ability to add to mobile wallet, daily and monthly card level limits, and programmatic authorization of card use.

Commercials

The main revenue stream generated by charge cards is Interchange. A card swipe transaction will typically yield, on average, 0.5% more in interchange revenue when done with a credit card compared to a debit card.

How does Unit support Business Charge Cards?

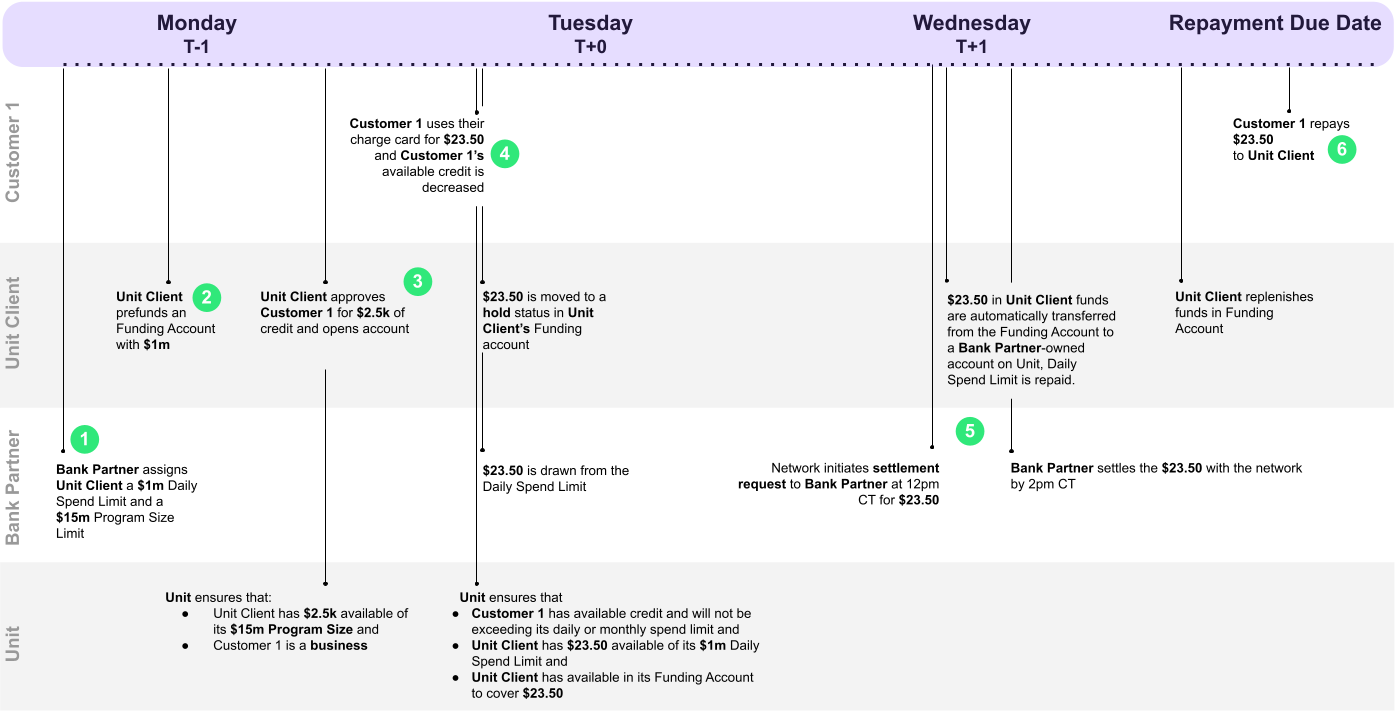

Unit’s Business Charge Card is a Bank-Sponsored charge card program in which your bank partner directly extends credit to your end customer (the bank is the lender). You will purchase from the bank 100% of the receivables created by your customers’ spend at a later date.

For more detail on the technical integration, please refer to our docs.

Program Size & Daily Spend Limit

As part of your onboarding process, the Bank will set a Program Size Limit, which represents the aggregate amount of credit the Bank can extend to your end customers. The Bank will set the Program Size Limit based on its assessment of your financial health (e.g. revenue, cash on hand, etc.).

Unit will also impose, on behalf of the bank, a Daily Spend Limit for your program. This represents the maximum amount of spend transactions that can be authorized in a given calendar day.

Your Program Size Limit may be equal to or greater than your Daily Spend Limit. Both can be periodically reevaluated as your program matures.

Credit Operational Account

You will fund an operational account, referred to here as a Credit Operational Account, in order to facilitate automatic purchases of receivables from your bank partner.

There must be sufficient funds available in the Credit Operational Account to cover the aggregate daily charge card spend of your end customers. If a customer attempts to transact and the amount is not available in your Credit Operational Account, the authorization will be declined.

All end-customer repayments are directed to the Credit Operational Account.

The required funding amount for your Credit Operational Account should take into consideration a number of factors, including your expected end customers' spend utilization. You and your bank partner will determine the frequency at which to replenish the Credit Operational Account.

You will be able to monitor the balance of the Credit Operational Account through the Dashboard and API.

Customer Credit Account

Credit accounts are how credit products are represented on the Unit platform. Credit accounts have a defined Credit Limit and they also have elements representing the account balance (the amount the customer owes) and the available Credit Limit (the amount the customer can spend).

You will create a credit account, and issue charge cards connected to that account on behalf of the Bank.

Bank-sponsored credit accounts can only be created for business customers. Sole proprietorships are not supported at this time.

Credit Limit

The Bank will determine the appropriate Credit Limit per customer credit account based on the Bank’s eligibility criteria and underwriting policy, and you will include this limit when creating a credit account on behalf of the Bank. The aggregate of your customer credit accounts cannot exceed your Program Size Limit, and there will be an established maximum credit limit per credit account.

Credit Terms

Customer credit accounts will be governed by a set of credit terms, including

The billing cycle: the period when all transactions are recorded on the charge card statement.

Repayment terms (the number of days after the monthly statement when repayment is due e.g. 30 days).

The clearing period for ACH Repayments.

Daily spend limit for a credit account and all associated cards under that account.

- This is typically used as a fraud control to prevent a full Credit Limit from being spent in one day, e.g., in the event a card number is compromised.

Fees assessed related to the program (at this time only nominal late fees are supported for Bank-Sponsored Charge Cards). APR will be available over time.

Maximum number of Physical or Virtual cards that can be created per account

A customer credit account cannot be created without credit terms. Unit will configure these terms for you in production prior to going live.

Cards

You will create physical and virtual cards for an end customer. These cards are used to access the credit account and can be added to a mobile wallet.

Card Limits

Card limits is the maximum amount to which a given card can spend in a given day or month. Different limits can be set for each card associated with the account.

Card-level limits cannot be greater than the daily spend limit configured on the credit terms. If you attempt to do so, the following error will be returned: The limits you are trying to set on the card exceed the account level limits

Currently cards associated with credit accounts cannot be used at ATMs. Therefore, the ability to set or manage a corresponding PIN is not supported.

Customer Spend

When the customer uses their charge card, Unit will verify that there is

Sufficient balance in your Credit Operational Account. If sufficient balance is not available, the authorization will be declined for

InsufficientFunds.Sufficient available Credit Limit on the customer’s credit account. If there is no sufficient available credit limit on the account, the authorization will be declined for

InsufficientFunds.Daily and monthly account and card limits are not exceeded. If limits would be exceeded, the authorization will be declined for

ExceedsAmountLimit.

If these conditions are met, an authorization will be created. This will create a hold on the customer’s credit account, and the customer’s available Credit Limit will decrease by the amount of the hold.

When the authorization posts to Unit's ledger, which depends on when the merchant clears the transaction but is typically by the next calendar day, a transaction will be created. The customer credit account’s balance will increase, the available Credit Limit will be unchanged (unless a purchase settles at a higher amount than originally authorized, like a restaurant tip), and the hold will decrease.

The amount your customers currently owe will be displayed in the Unit Dashboard or available via API under your program’s Org General Ledger Account.

Reserve Account: While the Credit Operational Account will ensure that all receivables created by customer transactions can be purchased from the bank, a reserve account will still be used in cases such as card disputes. The reserve formula will be a function of your expected spend utilization. A charge card Reserve Account will be created for your org and bank partner, or the required reserve amount increased to support the charge card program if you have existing programs with your bank partner.

Receivables Purchase

Each day, the newly generated receivables, meaning the settled transaction volume generated by your end customers’ spend, will be automatically purchased by you from the bank using the funds in your Credit Operational Account.

The amount you currently owe to the bank will be displayed in the Unit Dashboard or available via API under your program’s Org Loan Account.

Periodic Statement

Unit will generate periodic statements in line with detailed regulatory requirements on the statement date, and you will be responsible for distributing those statements to your customers. See Statements for more information.

Customer Repayment

By the end of each repayment cycle, the customer will repay their balance. You will facilitate the repayment by creating a Repayment using the Unit API (this sends your customer’s repayment instructions to the Bank). Repayments can be book payments or originated ACH debits.

Once the customer's repayment clears, it will decrease the balance of their credit account, as well as the aggregate balance your end customers owe to you.

Credit Policies

Bank Credit Policy

You must comply with the Bank’s governance and oversight of credit products as specified in the Credit Policy, including eligibility criteria and underwriting criteria. The Bank Credit Policy will define the evaluation process for underwriting criteria. The Bank will provide you with their Credit Policy applicable to your program.

Eligibility Criteria

Only business customers are eligible for this program. Sole proprietorships are not supported at this time. Eligibility criteria are set forth in the Bank Credit Policy, which includes (among other criteria) the following:

Applicant must be a legal commercial entity in the United States;

Applications must be submitted by an authorized representative of the commercial entity; and

The commercial entity must not be in an industry prohibited by the applicable Bank Partner.

If you have questions about defining eligibility criteria, please contact your Success Manager.

Daily Reporting is also required for a bank-sponsored program to ensure compliance. These reporting requirements may impact your implementation, so it is important to review these requirements in advance.

Customer Application Process

- Sequencing: Applications submitted by new customers will need to go through Unit’s end-customer application for KYB.

a. A business customer is required in order to create a credit account.

b. An application for credit that does not pass KYB will require an Adverse Action Notice. (See below)

c. Executing KYB first provides an important control for ensuring there is a record of each application.

Existing customers who have already undergone KYB on Unit by completing the end-customer application process, and therefore have a customer ID, will not be required to complete the application process again to open a credit account. However:

If your end customer is an existing customer of a different bank partner than your charge card program, the customer needs to understand that their information will be shared with a second partner bank as well. Your Privacy Policy may likely already cover this.

The customer needs to confirm their information has not changed.

- Submission: An application is considered submitted when the minimum required information to reach a decision per the Bank’s Credit Policy has been provided by the applicant, including necessary consents. If, for example, additional documentation is determined to be needed, the application is still considered submitted.

In addition to the criteria in the Bank’s Credit Policy, you will be required to retain and provide reporting on:

a. Application created timestamp

b. Application submission timestamp

c. Decision: The details of the credit decision need to be retained and reportable. In the event an application is denied, the applicant will need to be informed of the reason(s) they were not approved via an Adverse Action Notice.

Adverse Action Notices

In the event a customer is denied, they will need to be informed of the reason(s) they were not approved, called an Adverse Action Notice. Unit will provide templates that comply with regulation and align to the Bank’s Credit Policy. An example of what this may look like is below.

You will be responsible for the delivery of this notice, either directly in your UI or via email.

This notice must be delivered to the applicant - in your UI, via email, or other approved delivery method - within 30 days of application submission.

You will need to retain and provide reporting on:

a. Decision

b. Application decision timestamp

c. Decision reason(s)

d. Adverse Action reason(s), if denied, and all variable components of Adverse Action Notice

e. Key factor(s) if a credit bureau was used, if denied

Sample Adverse Action Notice

End Customer Terms and Conditions

An end customer will need to be presented and consent to terms and conditions when opening a charge card, this includes

Your Privacy Policy

Consent to Electronic Disclosures

Charge Card Cardholder Agreement

Spend

Card Spend

When your end customer uses their charge card, typically an authorization will be attempted. The possible reasons for a declined authorization are the same as for a debit card.

If an authorization would cause an account or card to exceed its credit limit, the authorization will be declined for InsufficientFunds.

If it would exceed its daily/monthly limit on the account or card, ExceedsAmountLimit will be returned.

Disputes

Bank-sponsored business charge card disputes will follow a similar lifecycle and procedure as debit/deposit disputes, both of which are covered in Unit’s Dispute Overview and Fraud & Disputes guides.

For charge card accounts, if a transaction is disputed,

A provisional credit may be issued from your reserve and the charge card account’s balance decreased accordingly.

If the dispute is denied, the provisional credit will be reversed and the charge card account’s balance increased accordingly.

Account Management

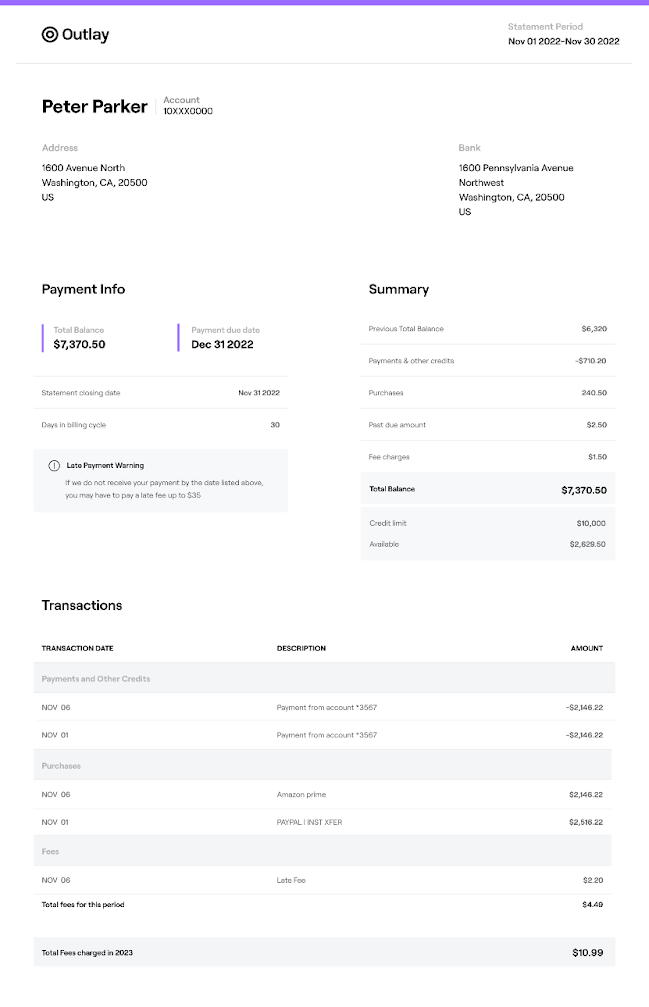

Statements

Unit will generate periodic statements in line with detailed regulatory requirements. A sample statement is shown below for reference.

You will be notified that a credit account statement is available via webhook. You’ll then leverage the Statements APIs for retrieving and delivering statements.

Statements are generated on the first of every month, meaning the statement cycle starts at the beginning of the month and ends at month-end. Statement cycles therefore range from a minimum of 28 to a maximum of 31 days.

Sample Statement

Credit Limit Management

End customer credit limits can be increased or decreased from their limit granted during initial underwriting.

Credit limit changes are subject to the same Reporting requirements as initial underwriting. The Adverse Action Notice process may also apply.

End customers may at times request credit limit decreases, which cannot be denied but may cause the account to go overlimit.

You can also proactively change credit limits - without a specific request from your end customer - in accordance with the Bank's Credit Policy.

- If a credit limit is decreased, an Adverse Action Notice is required.

Bank-sponsored credit accounts do not support credit bureau reporting at this time. Because the bank is the lender, you cannot report to credit bureaus directly. Unit may support credit bureau reporting in the future.

Repayments

You will use Unit’s Repayments API to create book or ACH repayments.

Your program’s repayment terms will be reviewed by the bank as part of their initial due diligence terms and if approved, disclosed in the terms and conditions presented to your end customer. This includes the structure and timing of any late payment fees, if you choose to support them.

Repayment due dates will be configured by Unit on your program’s credit terms to be a number of days after the statement is generated, typically 30 days from that date.

For example,

- Your customer opens their charge card on Jan 13.

- They spend $238.43 from Jan 13 - Jan 31.

- On Feb 1, Unit generates a monthly statement for their charge card account including the $238.43 in transactions.

- Your repayment terms are configured to be +30 days after the statement is generated.

- Your end customer initiates repayment on March 2, expected to clear 3 days later. Their repayment is honored as of March 2 and they are not considered late.

By default, repayment terms, including late fees, cannot be changed on an existing account. Changes in repayment terms will require a change in terms notice sent in advance to any changes to your end customer.

Repayment Types

- Book Repayment: the credit account balance will decrease and available Credit Limit will increase immediately.

- Currently, a book repayment will require that the counterparty account is held under the same bank partner as the destination account of the repayment.

- ACH Repayment: the credit account balance will only decrease and the available Credit Limit will increase once the ACH debit clearing period is over.

- Note that, unlike a DepositAccount, a CreditAccount does not have a specified routing and account number for recognition in the ACH network. As such, an ACH Credit originated externally cannot be used to repay a credit account.

To prevent overpayment, repayments cannot exceed the outstanding balance, less any pending repayments.

Repayment Frequency

One Time Repayments

You must allow your customers to pay all or part of their balance early, via one time repayments, which will be either book repayments or ACH repayments. Authorization is required for repayments.

Automatic Repayments

You can offer Automatic Repayment functionality for your end customers to repay their previous balance (this cannot include current cycle purchases).

For example,

Your end customer’s billing period ends with a balance of $350. This amount is disclosed to your end customer.

They make a one time repayment of $50 via ACH debit which posts after the clearing period. (Balance is now $300)

They make a new transaction of $75. (Balance is now $375)

The automatic repayment on their due date is then adjusted to $300. It does not include the purchases made in this period. (Balance after automatic payment posts is now $75)

Late Repayments

You will be responsible for determining when a repayment is late.

In the event a customer does not repay their balance in full on time, you can freeze the associated cards to prevent further spend. If the balance is then repaid, you can unfreeze the cards.

Frozen accounts can accept repayments. In the event of a late repayment, freezing an account freezes all associated cards to prevent additional spend.

If the late balance is not repaid in full after three ACH Debit attempts (eg. insufficient funds), you can close the end customer’s credit account. The three attempts must be made within 180 days of the corresponding purchase date.

Returned Repayments

When an end customer repays via ACH Debit repayment, the balance and available Credit Limit will remain unchanged until the repayment posts.

If an end customer’s repayment is returned:

Before it has posted, their balance and available Credit Limit remain unchanged.

After it has posted, their balance increases by the amount of the returned repayment and the available Credit Limit remains unchanged. This may cause the customer credit account to go over their Credit Limit if they have spent further after the repayment originally posted.

Most returns for repayments will occur within 3 business days. If a returned repayment causes an account to become late, you can begin to assess late fees.

Late Fees

You can also choose to assess late fees in the event of a late repayment, with the Bank’s approval.

Unit’s Fees API should be used to assess late fees.

The description attribute on any fees you assess must match exactly how the fee is disclosed in your program’s end user terms.

Late fees can be assessed when you determine a repayment is late or a set number of days afterward, referred to as a grace period. The grace period can be useful in the event a repayment has been made but is later returned, often within 3 business days.

For example,

A repayment of $1,000 is due on May 1. No repayment is made by May 1.

Your program has a grace period of 3 days.

The repayment still has not been made by May 4, at which point you assess a late fee.

Late fees for bank-sponsored business charge cards can only be assessed against an outstanding principal balance. At this time, late fees cannot be compounded.

For some fee structures, there may be pass-through fees from the bank as a percentage of late fee dollars assessed. These will be assessed in arrears, and included in your monthly invoice from Unit.

For example,

In March, your end customer spends $12,500. On April 1, their March statement balance is $12,500 due by May 1.

On April 4, they spend an additional $500.

Your end customer does not make their repayment by the due date, May 1.

On May 2, you assess a late fee of 2% on the outstanding principal balance of $12,500, amounting to $260. The additional $500 spent in April is not yet late and therefore not included in the late fee calculation.

Rewards

You can use Unit's Rewards API to send rewards to your end customers by specifying the receivingAccount with type creditAccount.

When you send rewards to a credit account, you are reducing the balance of that account, and in effect the amount that customer will ultimately repay to you. This will also increase your end customer's available credit limit.

Since this is simply reducing a balance owed, there is no actual fund movement (e.g. the reward amount does not need to come out of your revenue account). Therefore you should not specify a

fundingAccountin your request.You cannot issue a reward that would cause a credit account's balance to go below $0.

Reporting

Unit and your bank partner will need the ability to monitor your program for compliance. The scope of monitoring for this program will rely on reporting provided daily to Unit by your program. You will submit this reporting via our Credit Decisions API.

Marketing and Complaints will require reporting to Unit by your program, as described in Unit’s guides.

Roles and Responsibilities

| Bank-Sponsored Charge Card | |

|---|---|

| Lender | |

| Program Approval | |

| Network & Settlement | |

| Credit Policy & Underwriting | |

| Credit Limit Management | |

| Statements and repayment terms | |

| End Customer Repayments & Fees | |

| Servicing | |

| Reporting & Monitoring |

Implementation

Program Approval

The bank will collect the following as part of due diligence for review and approval.

Due Diligence Questionnaire, including proposed:

Repayment terms

Late fee structure and grace period, if applicable

Any other program fees

Rewards program, if applicable

If you have questions about what information you need to provide on your credit program, please contact your Success Manager.

Legal Agreements

The following agreements will need to be executed in order to go live:

Program Terms: Your agreements with Unit and your bank partner will include the Bank-Sponsored Business Charge Card. Unit will provide these agreements for your review.

Receivables Purchase agreement: Details the terms and mechanism by which you will purchase receivables from the bank. Unit will provide this agreement for your review.

End Customer Charge Card Agreement: For your end customer, Unit and your bank partner will provide templated terms and conditions, including the terms of card issuance, use of the charge card account, repayment terms and fees. These terms and conditions will establish the end customer as a direct customer of your bank partner.

Technical Implementation

Review Unit's documentation for credit accounts.

Create a customer resource via a business application if the customer does not already exist.

Create a credit account for the customer.

- Specify the credit terms and credit limit.

Create physical or virtual cards with type set as

businessCreditCardorbusinessVirtualCreditCardMaintain the repayment period, including making the end customer aware of any outstanding balance from the previous period.

Use Unit's repayment capabilities (book payment or ACH) to orchestrate repayment.

Going Live

You will need to have a pen test completed for your charge card endpoints. This includes programs that are already live with other products.

Execute legal agreements to participate in the Charge Card program, including a Business Deposit Agreement for the Credit Operational Account, Reserve and Revenue accounts

Unit will then enable your org for charge cards

Fund the Reserve and Credit Operational Accounts created for you.

Receive the credit terms created for you, including your expected:

a. Card Issuing Fee

b. Account-level daily spend limit

c. Max number of physical cards

d. Max number of virtual cards

e. Clearing days for repayments

- Create your first credit account and cards

If you are already live in production with Unit, you will not need new API keys.