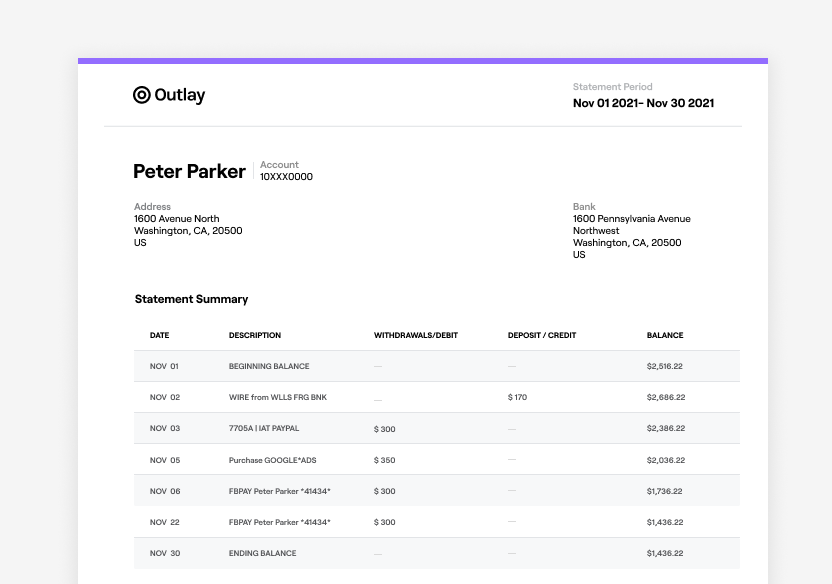

Statements

Statements are generated automatically and gradually at start of each month, and providing them to your customer is a regulatory requirement. This allow your customers to keep track of money movements and act on any fraudulent charges or mistakes.

While Unit generates statements for both deposit and credit accounts in line with detailed regulatory requirements, you will be responsible for distributing those statements to your customers. Statements must be enabled by Unit for credit accounts.

Unit provides a cross-platform suite of flexible and customizable white-label UI components, including an account component, through which the end customer can access their monthly statements. You may embed the components into your app to shorten your time to market and deliver a highly optimized experience to your end customer with minimal engineering investment.

Statements are static documents. To show your customers a list of transactions within your user interface, use the Transactions API. You may also choose to embed the activity component from our white label UI suite into your app, to provide a highly optimized experience with minimal investment.

Unit provides white-labeled HTML based account statements, supporting all browsers, devices and standard screen resolutions, and eliminating any need for custom development work on your side. Customizing the statement is done through the Unit Dashboard (under Org Settings > Branding).

Unit supports all font types but recommends using *.WOFF for best results

Statements are also available as a pdf, and support both English and Spanish.

- Statements are generated at the start of every month.

- A statement will be created even if an account had no activity during a certain month.

- If an account is created within a given month, a statement for that particular month will be produced only if the account creation occurs before the respective bank's end-of-day time on the final day of that month. To illustrate, if the bank's daily cut-off is 7:00 pm (EST) and the account was created on July 31, 2023, at 7:05 pm (EST), no statement will be generated for the account for the month of July.

- Transactions not completed before the bank's end-of-day time on the final day of the month will be featured in the subsequent month's statement. To illustrate, if the bank's end-of-day time is 4:00 pm (EST) and a transaction takes place on 07/31/23 at 4:05 pm (EST, the transaction won't be included in the account's July statement, but only in the August statement.

- If an account is closed during a certain month, a statement for that period would be created.

List statement resources. Filtering and paging can be applied.

| Verb | GET |

| Url | https://api.s.unit.sh/statements |

| Required Scope | statements |

| Timeout (Seconds) | 5 |

Query Parameters

| Name | Type | Default | Description |

|---|---|---|---|

| page[limit] | integer | 100 | Optional. Maximum number of resources that will be returned. Maximum is 1000 resources. See Pagination. |

| page[offset] | integer | 0 | Optional. Number of resources to skip. See Pagination. |

| filter[accountId] | string | (empty) | Optional. Filters the results by the specified account id. |

| filter[accountIds][] | string | (empty) | Optional. Filters the results by the specified account ids. Usage example: filter[accountIds][0]=10000&filter[accountIds][1]=10001 |

| filter[customerId] | string | (empty) | Optional. Filters the results by the specified customer id. |

| filter[period] | ISO8601 Date string | (empty) | Optional. Filters the results for a specific month. e.g. 2021-01 |

| sort | string | sort=period | Optional. Leave empty or provide sort=period for ascending order. Provide sort=-period (leading minus sign) for descending order. |

curl -X GET 'https://api.s.unit.sh/statements?page[limit]=20&page[offset]=10' \

-H "Authorization: Bearer ${TOKEN}"

Response

Response is a JSON:API document.

200 OK

| Field | Type | Description |

|---|---|---|

| data | Array of Statement | Array of statement resources. |

{

"data": [

{

"type": "statement",

"id": "1",

"attributes": {

"period": "2020-07"

},

"relationships": {

"account": {

"data": {

"type": "account",

"id": "1000"

}

},

"customer": {

"data": {

"type": "customer",

"id": "1"

}

}

}

},

{

"type": "statement",

"id": "2",

"attributes": {

"period": "2020-08"

},

"relationships": {

"account": {

"data": {

"type": "account",

"id": "1000"

}

},

"customer": {

"data": {

"type": "customer",

"id": "1"

}

}

}

}

]

}

Get a statement HTML output by id.

| Verb | GET |

| Url | https://api.s.unit.sh/statements/{id}/html |

| Required Scope | statements |

| Timeout (Seconds) | 5 |

Query Parameters

| Name | Type | Default | Description |

|---|---|---|---|

| filter[customerId] | string | (empty) | Optional. Verify that the statements belongs to the customer. |

| language | "en" or "es" | "en" | Optional. Select the statement language. en - English, es - Spanish |

Response

Response is a HTML document.

curl -X GET 'https://api.s.unit.sh/statements/1/html' \

-H "Authorization: Bearer ${TOKEN}"

Get a statement PDF output by id.

| Verb | GET |

| Url | https://api.s.unit.sh/statements/{id}/pdf |

| Required Scope | statements |

| Timeout (Seconds) | 240 |

Query Parameters

| Name | Type | Default | Description |

|---|---|---|---|

| filter[customerId] | string | (empty) | Optional. Verify that the statements belongs to the customer. |

| language | "en" or "es" | "en" | Optional. Select the statement language. en - English, es - Spanish |

Response

Response is a PDF document.

curl -X GET 'https://api.s.unit.sh/statements/1/pdf' \

-H "Authorization: Bearer ${TOKEN}"

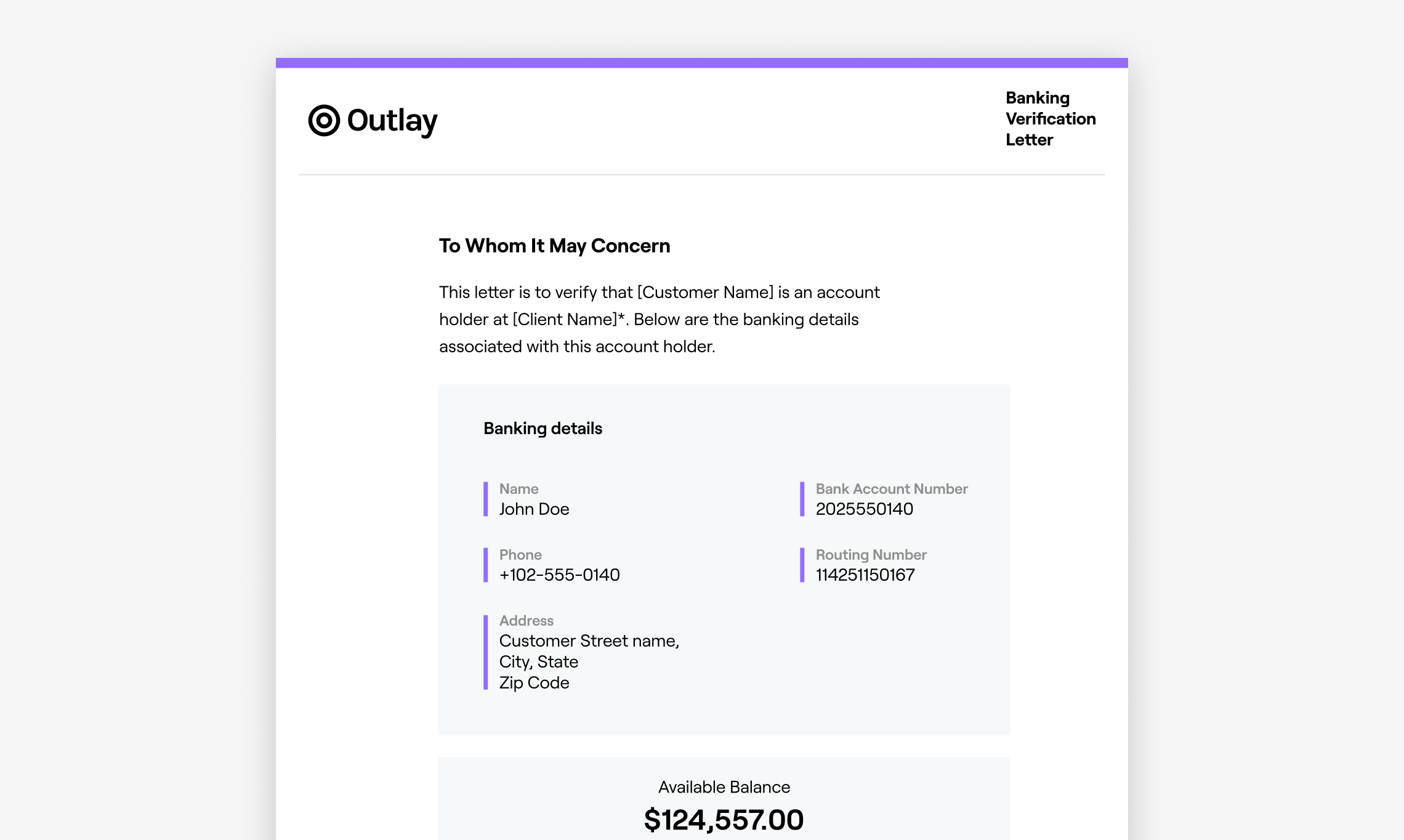

Customers may be required, for various reasons, to provide proof that they hold a bank account with a certain financial institution. This is typically provided by the bank in a letter called "Bank verification letter", which includes the customer, account and financial institution information. If the customer is required to prove availability of funds, the letter may also include the available balance on the account.

The API returns a white-label bank verification letter. The white label configuration including the logo, representative name, email, and phone is done through the Unit Dashboard settings. Verification letters can be accessed immediately after an account is approved.

Logo, representative name, email, and phone number in Org Settings > Branding are all required fields to generate a bank verification PDF.

Unit supports all font types but recommends using *.WOFF for best results

| Verb | GET |

| Url | https://api.s.unit.sh/statements/{accountId}/bank/pdf |

| Required Scope | statements |

| Timeout (Seconds) | 180 |

Query Parameters

| Name | Type | Default | Description |

|---|---|---|---|

| includeProofOfFunds | boolean | false | Optional. include customer proof of funds |

Response

Response is a PDF document.

curl -X GET 'https://api.s.unit.sh/statements/1/bank/pdf' \

-H "Authorization: Bearer ${TOKEN}"