The complete guide to understanding and reducing chargebacks

Chargebacks are costly for marketplaces, merchants, & card-issuing programs. Discover 8 ways to reduce operating costs and improve your customer experience.

Understanding chargebacks and their business implications

Chargebacks occur when a cardholder attempts to reverse a card transaction through the bank that issued their card.

Obviously, they don’t represent an ideal outcome. So it’s natural that many product leaders want to drastically reduce or even eliminate them completely.

In meaningful ways, chargebacks are bad for business. In addition to reducing revenues, they can be time-consuming and expensive to process.

By developing a plan to thoughtfully reduce chargebacks, you can use them to build trust in your product.

At the same time, it’s important to acknowledge that chargebacks are an essential safeguard for cardholders. By developing a plan to thoughtfully reduce chargebacks, you can actually use them to build trust in your product.

This guide is for leaders at marketplaces, merchants, and card-issuing programs who are thinking about how to intelligently manage chargebacks. In it, we’ll help you develop a chargeback mitigation strategy and, in the process, build lasting relationships with your customers. We’ll answer questions like:

- What are chargebacks?

- Why do chargebacks occur?

- How do chargebacks impact your business and customers?

- What can you do to reduce chargebacks?

- How can an experienced partner help mitigate chargebacks?

What is a chargeback?

Chargebacks are the attempted reversals of credit-, debit-, or charge-card transactions that occur when an end-customer disputes a transaction with the bank that issued their card. They’re most common in cases of damaged or defective goods, incorrect charges, and fraud.

In 1974, the Fair Credit Billing Act (FCBA) established the legal framework for disputing credit card transactions . It was enacted to instill confidence in new forms of credit by allowing consumers to challenge errors and unfair billing practices.

Nearly all non-fraud-related chargebacks can be reduced or eliminated by making it easy for end-customers to reach out to merchants.

Today, there are many ways for a customer to dispute a card transaction; they include talking to a customer-service representative on the phone or via chat, visiting a bank branch, and tapping a few buttons in the app or website where they manage their card.

Chargebacks represent a negative event for everyone involved. For the end-customer, they're the culmination of a bad purchase experience, a billing error, or attempted fraud. For both the merchant and the marketplace, they represent lost revenue. For the card-issuing program and the card network, they’re expensive and time-consuming to process.

Thus, it’s ideal to reduce their frequency. Product leaders should consider the impact of chargebacks on the cardholder experience as well as on their own economics, since there are both time- and system-borne costs associated with intaking, processing, and resolving them.

Why do chargebacks occur? (Some common reasons)

Broadly, chargebacks can be divided into two categories: fraud-related and non-fraud.

Fraud-related chargebacks

- Criminal fraud. In this type of fraud, an end-customer initiates a chargeback for an unauthorized transaction on their lost or stolen card. With chip cards offering more security than the old magnetic-stripe cards, today’s fraud-related chargebacks mainly occur with online or card-not-present (CNP) transactions. In fact, CNP fraud is 81% more likely in the United States than point-of-sale (in-person) card fraud.

- Friendly fraud. In this type of fraud, an end-customer claims that the transaction was fraudulent even though they did, in fact, authorize it. Some cases may occur due to genuine confusion about billing or the returns process. Sometimes the customer truly can’t recall making the purchase. In other cases, a fraudster buys a product, receives or uses it, and disputes the transaction anyway—a practice known as cyber-shoplifting.

Providing merchants with best practices for secure payment processing, clear refund policies, and customer authentication can help minimize the risk of fraud-related chargebacks. Later in this article, we will discuss more detailed strategies.

As a card-issuing program, how you proceed with a fraudulent chargeback will depend on whether you believe it represents criminal fraud or friendly fraud. Thus it’s important to differentiate between the two and develop distinct workflows around them. Technology and experience can help to reduce all types of fraud—but especially fraud from your own customers.

Non-fraud chargebacks

- Missing or damaged items. End-customers sometimes dispute card charges if their orders don’t arrive on time, if the merchant failed to deliver a product as described, or if the item(s) arrived in a damaged or defective condition.

- Billing errors. If an end-customer is charged multiple times for the same purchase, they may file a dispute. Other billing errors that could result in chargebacks include being charged the wrong amount, getting charged for canceled subscriptions, and delays in being credited for refunds.

Nearly all non-fraud-related chargebacks can be reduced or eliminated by making it easy for end-customers to reach out to merchants and get their issues addressed. If the merchant can’t otherwise resolve the problem, the end-customers should consider requesting a refund—and merchants should seriously consider granting it.

Why? Because refunds are customer-friendly, and they typically cost the merchant less than processing a chargeback. In addition, merchants who receive a lot of chargebacks experience reputational risk and are subject to enhanced compliance review from their payment processors.

How do chargebacks work?

A chargeback begins when an end-customer contacts the bank that issued the card they used to make a given purchase and disputes the transaction. (Card issuers may also choose to use a third-party provider to assist with dispute intake and resolution.)

Unless the dispute is obviously fraudulent or meritless, the bank typically deems it valid, and the chargeback proceeds as follows:

- In certain circumstances, including transactions with a low dollar value, the bank may decide to forgo submitting a chargeback to the network. In these cases, the bank permanently credits the end-customer’s account for the amount of the disputed transaction, and the process is concluded.

- Otherwise, the bank issues a provisional credit to the cardholder’s account for the amount of the disputed transaction and submits the chargeback to the card network (e.g., Visa or Mastercard).

- Notifications are sent to the merchant, their payment processor, their acquiring bank (the bank that processes their card payments), and their platform or marketplace (e.g., Etsy) as applicable.

Refunds are customer-friendly, and they typically cost the merchant less than processing a chargeback.

- The bank that processes the merchant’s card payments debits the merchant’s bank account for the amount of the transaction.

- The merchant (along with their platform or marketplace, if applicable) decides whether or not to contest the chargeback.

- If the merchant decides not to contest the chargeback, they forfeit the revenue from the original transaction. The provisional credit in the end-customer’s account becomes permanent, and the chargeback is concluded.

- If the merchant decides to contest the chargeback, they now have the opportunity to present evidence showing that the original transaction was valid. This part of the process is known as representment.

- If the network determines the chargeback is resolved in favor of the merchant, the provisional credit in the end-customer’s account is removed, and the funds are reinstated in the merchant’s account. (However, if the dispute is for an unauthorized transaction or a lost/stolen card, the provisional credit is not removed. In these cases, the card-issuing program takes the loss.)

- If the network determines the chargeback is resolved in favor of the end-customer, the provisional credit in the end-customer’s account becomes permanent. The merchant must not only forfeit the revenue from the original transaction, they must also pay any fees and/or penalties associated with the chargeback.

- If the chargeback remains unresolved after representment, the parties may attempt to continue the chargeback via a process known as arbitration. Arbitration is time-consuming and expensive; it can take months, and the losing party must pay hundreds of dollars in fees. For this reason, arbitration is rare, and it typically only occurs for transactions with a very high dollar value.

Chargebacks: an example

To show how chargebacks work, let’s use an example. Say you’re the VP of Product at Etsy.

One of your customers is Ladybug Tie Dye, a clothing merchant in Tulsa, Oklahoma. One of their end-customers calls the 1-800 number on the back of their Chase credit card and files a dispute, claiming their card was charged twice for a single purchase.

The end-customer’s bank (Chase) deems the case valid/worth investigating and issues a provisional credit on the end-customer’s account. Notifications are also sent to the card network (Visa), the merchant’s payment processor (Checkout.com), the bank that processes their card transactions (Wells Fargo), their marketplace (Etsy), and the merchant (Ladybug Tie Dye). These parties must now work together to determine the chargeback's outcome.

If the merchant and their marketplace decide not to contest the chargeback, they simply forfeit the revenue, and the story ends there.

At the same time, the end-customer’s bank (Chase) begins the process of reclaiming the funds from the merchant until the claim has been investigated and resolved.

At this point, the merchant (Ladybug Tie Dye) and their marketplace (Etsy) must decide whether or not to contest the chargeback. If they decide not to contest it, they simply forfeit the revenue, and the story ends there.

If they decide to contest the chargeback, the merchant will have the opportunity to present evidence demonstrating the transaction's validity. This could include logs showing that the end-customer made two separate purchases and/or delivery confirmations from the shipping company.

If the merchant successfully contests the chargeback, the transaction will be reinstated, and the funds will be returned to the merchant’s account. On the other hand, if the merchant loses the case, they must forfeit the original funds and pay any fees and/or penalties associated with the chargeback.

How chargebacks impact your business

Reducing chargebacks can dramatically improve customer relationships. Here are a few other reasons to invest in a chargeback mitigation strategy.

- Platforms and marketplaces. On average, you’ll pay about $15 to your card network or payment processor for every chargeback. There’s also a reputational risk, as merchants tend to avoid platforms known to experience a lot of chargebacks. Finally, chargebacks can trigger compliance issues. If you exceed acceptable limits, your bank and/or payment processor may assess fees, conduct audits, and even terminate your account.

- Merchants. For the merchant, chargebacks represent lost revenue. In fact, according to LexisNexis, each dollar of chargebacks costs U.S. retail and ecommerce merchants $3.75. The difference is due to added fees, increased operational costs, and other associated losses. Similar to platforms, merchants with excessive chargebacks can be terminated by their platform, bank, or payment processor.

- Card-issuing programs. For issuing banks and the tech companies they partner with, chargebacks are a source of significant operational costs—not to mention, a keen source of cardholder frustration. Each chargeback costs the card-issuing program between $15-$35, not to mention the operational costs associated with intaking and processing each dispute.

- End-customers. For end-customers, chargebacks generate a lot of frustration and a loss of trust—and not just in a given merchant. If end-customers have a bad experience on your platform or marketplace, they’re less likely to return. Additionally, chargebacks result in increased cost of goods and services, as platforms, marketplaces, and merchants typically pass along the associated high costs.

How to prevent chargebacks

Marketplaces, merchants, and card-issuing programs should prioritize chargeback mitigation.

First, it’s good for business. Chargebacks are expensive, and implementing a thoughtful strategy to reduce them can result in significantly lower operational costs and less lost revenue.

Second, such a strategy can potentially reduce your compliance risk and boost your reputation. While disputes can never be entirely eliminated—they represent an important protection for cardholders—a consistent pattern of chargebacks will have business repercussions.

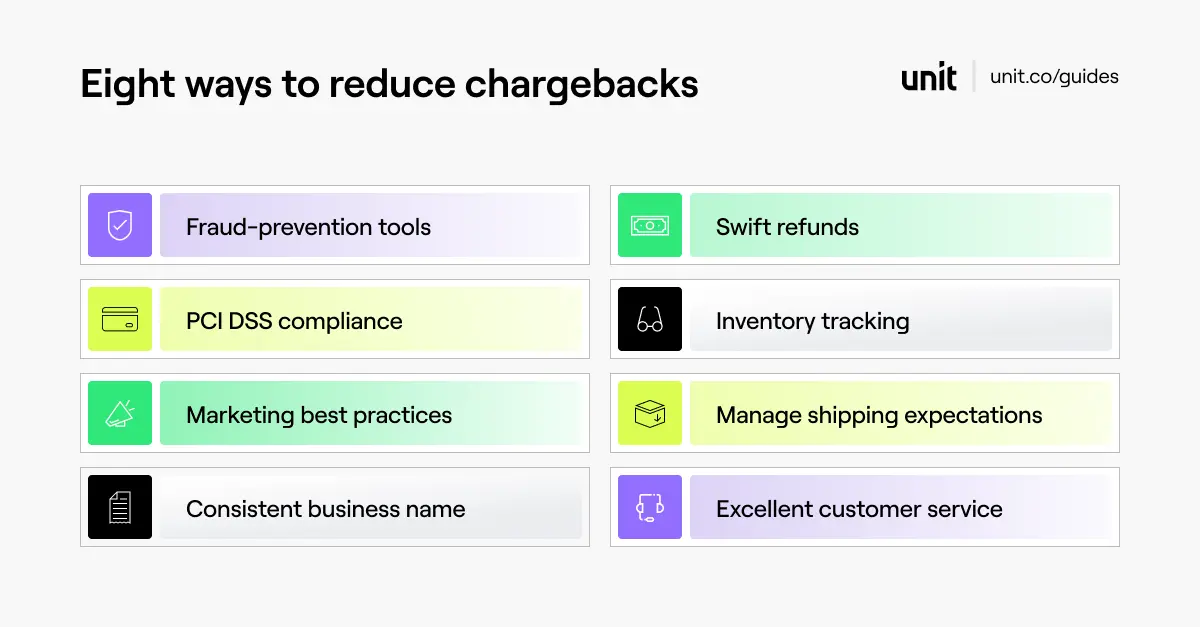

Here are eight strategies to include in your chargeback reduction plan:

1. Implement fraud-prevention tools and processes

Effective fraud-prevention measures include transaction verification and data encryption. As a platform or marketplace, you can also put policies in place requiring merchants to collect and keep evidence needed to support a chargeback case defense. Machine-learning tools can be deployed to monitor transactions in real time and automatically flag suspicious activity for manual review.

Merchants should take advantage of the fraud-prevention tools that marketplaces have built, perhaps even augmenting them with proprietary customer data. For their part, issuing programs should take steps to prevent account takeover, a key source of fraudulent chargebacks.

2. Become PCI DSS compliant

Payment Card Industry Data Security Standard (PCI DSS) compliance guidelines can provide marketplaces and merchants with a framework for securing cardholder data and preventing fraud. Reducing fraud and data breaches directly impacts the number of chargebacks a business may face. (Learn more about PCI DSS compliance in our guide.)

3. Follow marketing best practices

End-customers won’t hesitate to initiate a chargeback if the item they received is different from what was advertised on the website. Merchants should follow marketing best practices, providing detailed and accurate product pages. Marketplaces can equip their merchants with marketing resources to make their job easier.

4. Ensure a consistent business name on receipts

Many end-customers will dispute a card charge if they don't recognize the business name on their statement. At the same time, customers are less likely to dispute a charge from a brand they trust. For merchants and marketplaces, maintaining a consistent business name on your website and transaction receipts prevents confusion. Meanwhile, card-issuing programs should do their best to offer cardholders clear and concise transaction data on statements, in mobile apps, and in other transaction records. (If you make cards available to your customers and want to learn more about how to ensure a consistent business name on transaction records, check out our transaction enrichment guide.)

5. Provide a clear return policy and swift refunds

Although merchants may prefer to avoid all transaction reversals, refunds are actually much less expensive and easier to manage than chargebacks. Combining a straightforward return policy with fast refunds can prevent end-customers from disputing a charge in the first place. As a bonus, businesses with transparent return policies are more likely to receive repeat business and referrals. Marketplaces can and should require this from their merchants.

6. Offer inventory tracking

For marketplaces, online inventory-tracking features (e.g., low-stock notifications and inventory audits) can help merchants optimize inventory management, reduce operational costs, improve customer service, and increase sales. When kept up-to-date, these systems reduce chargebacks by preventing merchants from accidentally processing orders for out-of-stock items.

7. Manage shipping expectations

If their packages don’t arrive on time, end-customers may initiate a chargeback. To prevent this, merchants should provide detailed shipping information, including methods, costs, delivery times, tracking numbers, insurance options, and return policies. Merchants should also provide regular status updates during the order fulfillment process and include a proof-of-delivery document for every order they send out. Marketplaces can and should require this from their merchants.

8. Encourage excellent customer service

Providing outstanding customer service is one of the most effective ways to reduce chargebacks. Simply put, when merchants are friendly, transparent, and available, end-customers will generally choose to resolve their issues with the merchant rather than their bank. Marketplaces should inform merchants about expectations regarding customer service; they should also implement systems and processes to reinforce these high standards.

Issuing programs should also plan to provide outstanding service to their cardholders during the chargeback process. Customers who feel they haven’t been treated fairly are likely to take their business elsewhere; they may also file complaints with regulators. Offering clear, cardholder-friendly service during disputes can boost NPS scores and other metrics of program health.

Chargebacks and merchant rights

Educating merchants on their rights is a simple way to help protect them from inappropriate or unnecessary chargebacks—while improving your own metrics.

Merchants can challenge chargebacks they believe to be fraudulent. By the same token, the bank that issued the card can deny the merchant’s claim. This leads to a months-long process arbitrated by the card network (e.g., Visa or Mastercard). According to the 2022 Chargebacks Field Report, 72% of merchants reported contesting invalid chargebacks, but the average net recovery rate was less than 9%.

72% of merchants reported contesting chargebacks, but the average net recovery rate was less than 9%.

If the original chargeback is found to be valid, the merchant must pay not only the original amount but also hefty arbitration fees. So it’s important for merchants to be aware of the process and be strategic about whether and when to challenge a chargeback. In general, merchants should be encouraged to contest fraudulent chargebacks only if they have solid evidence to support their case.

Merchant rights in chargeback cases depend on the timing of the chargeback, the rules of that particular card network (e.g., Visa or Mastercard), and relevant regulations. They include:

- Right to representment. Merchants can challenge a chargeback if they believe it is unwarranted.

- Right to 15 days. In certain circumstances, card-issuing programs must wait 15 days before processing a chargeback. These include: 1) nonreceipt of merchandise/services, 2) merchandise/services not as described, and 3) merchandise/services canceled. This gives merchants time to process a refund and avoid a chargeback, if they desire.

- Right to reason codes and documentation. Merchants have the right to receive the issuer's chargeback reason code and any supporting information.

- Right to zero cashback disputes. Cashback transactions are those in which the cardholder asks to be charged more than the value of purchased goods and services. They then receive the extra money as cash. Cardholders can’t dispute the cashback portion of a transaction, as it would result in their receiving the money twice.

- Right to late delivery. If merchants can prove that the late delivery of goods or services was due to circumstances beyond their control, they may be able to avoid a chargeback. In order for the chargeback to stand, the card issuer must verify that the customer attempted to resolve the issue with the merchant before filing a dispute.

To reduce chargebacks, work with an experienced partner

Chargebacks are an important challenge for platforms and marketplaces that accept card payments—but they’re hardly the only challenge, or the most important.

Fortunately, it’s possible to work with an experienced partner who can drastically reduce the amount of time and resources you’ll need to devote.

Unit is a banking-as-a-service platform. We help companies like yours (nearly 200 of them) keep more of their customers’ money “on the platform” by offering embedded bank accounts, cards, and financing options. Thanks to customizable white-label UIs, our customers can usually launch embedded financial products in weeks.

We also handle chargebacks for our clients’ card-issuing programs. In other words, when an end-customer (i.e., cardholder) disputes a card transaction, we work with Visa DPS to resolve it.

Want to chat about chargebacks? Ready to launch your own card-issuing program? Request a demo or start building in our sandbox.

Frequently asked questions

Chargeback vs refund: what’s the difference?

Both refunds and chargebacks involve the reversal of a transaction, but there are important differences.

- Refunds are initiated by the seller, often in response to a customer request, and are typically straightforward.

- Chargebacks involve a more complex dispute resolution process, where the customer and the merchant may be required to provide evidence to support their claims.

As a result, refunds are typically easier and much less expensive to process.

How many chargebacks is a merchant allowed?

The maximum number of chargebacks a merchant is allowed depends on their card network.

Visa classifies merchants into three chargeback threshold categories—Early Warning, Standard and Excessive.

Mastercard uses a framework called the Excessive Fraud Merchant (EFM) program. The following thresholds must be met for a company to be considered an EFM:

- The merchant processed a minimum of a thousand transactions.

- The merchant reported more than $50 thousand as monthly net fraud.

- The merchant gained at least 50 monthly net fraud rate basis points.

If merchants continually exceed chargeback thresholds set by the networks and their acquirers, they risk penalties up to and including having their ability to accept card payments turned off.

Are chargebacks getting better or worse?

Actually, there’s some good news here.

Midigator’s recent analysis of 81 million transactions shows that the average chargeback-to-transaction ratio dropped by 21.6% from 2020 to 2021. The same study also found that the total amount of revenue lost to chargebacks decreased by 39.4% within the same time period, thanks to an active effort to manage risk by all stakeholders.

Taking proactive measures to understand and reduce chargebacks can make a real difference. But, in order to do that, it’s important first to understand why chargebacks occur.

How thoroughly do banks investigate chargebacks?

Financial institutions take chargebacks and card fraud seriously. The investigation process can last anywhere from a few days to several months, depending on the complexity of the case and the cooperation of the parties involved. Banks gather and review evidence before submitting chargebacks to the network.

In addition, the bank may consult third-party sources, such as fraud databases, to verify the transaction's authenticity and confirm that the charge matches the cardholder's usual spending pattern.

In what circumstances can you deny a chargeback?

Platforms and sellers operating on them can’t actually deny a chargeback. The final decision depends on the rules of the card network.

That said, platforms can take proactive measures to mitigate chargebacks, gather relevant information to aid their sellers in contesting chargebacks, and provide a framework for when and how to challenge chargebacks.

What incentives can you offer merchants to reduce chargebacks?

Platforms can reward sellers who maintain low chargeback rates with reduced fees, faster payouts, higher account limits, and/or better rewards. Platforms can also offer merchants visibility and marketing opportunities as an incentive for using a consistent brand name and description.