An introduction to banking as a service

Banking as a service enables tech companies to offer financial products to their customers. Learn how it works, why it's valuable, and how to get started.

The rise of the BaaS company

According to Bain & Company, tech companies could realize $51 billion in new revenue by offering embedded financial products—including those powered by banking as a service—by 2026.

Especially in an uncertain economy, these robust new revenue streams can be appealing to forward-looking company leaders. They naturally ask, “What is banking as a service?”

In an uncertain economy, these robust new revenue streams can be appealing to forward-looking company leaders.

If you’re thinking about ways to differentiate your product, deliver more value to your customers, drive more revenue from existing customers, and lower customer-acquisition-costs, this guide is for you. In it, we’ll take a big-picture look at banking as a service and answer the following questions:

- What is banking as a service (BaaS)?

- What kinds of financial products and services does it enable?

- Why would my customers want this?

- What companies are already doing this?

- How do companies make money from embedded finance?

- What should I look for in a BaaS provider?

What is banking as a service (BaaS)?

Banking as a service is a way for tech companies to partner with banks in order to make the bank’s financial products (e.g., bank accounts, credit cards) available to their customers.

Under this partnership model, a chartered bank allows a tech company to market the bank’s products under the tech company’s brand name. For example, although it is not a bank, Apple makes the Apple Card (a credit card) available to its customers. In order to do so, Apple partners with Goldman Sachs, a bank. (Here’s what it might look like if Apple offered bank accounts.)

Many companies that make financial products available to their customers choose to partner with a bank with the help of a banking as a service (BaaS) platform.Depending on its scope of services, a BaaS platform may help you with some or all of the following:

- Introducing the tech company and a bank partner

- Providing the technology infrastructure needed to make financial products available

- Helping the tech company define, launch, and market their financial offering

- Streamlining compliance obligations, both initially and on an ongoing basis

What financial products can I offer by partnering with a BaaS platform?

By partnering with a banking as a service platform, you can make many of the same financial products that your bank partner offers available to your customers.

Broadly, they fall into four categories:

- Bank accounts. Accounts are the foundation of most banking services. They allow your customers to deposit and withdraw funds, as well as make and receive payments. One of the main advantages of bank accounts over similar solutions (e.g., digital wallets) is that they may be insured up to $250,000 by the Federal Deposit Insurance Corporation. Some bank accounts also generate interest. (learn more)

- Debit, credit, and charge cards. Cards (including virtual cards) allow your customers to make payments at the point of sale, either online or in person. They can be a great way to drive acquisition, engagement, and retention. They also generate interchange revenue, a potentially powerful new revenue stream for your business. (learn more)

- Payments. Broadly speaking, payments involve moving funds into and out of bank accounts. Payment methods that can be enabled by banking as a service include ACH, cards, wires, and internal transfers between accounts at the same bank. (learn more)

- Lending and financing. When you make lending and financing products available to your customers, you’re giving them access to funds they don’t already have in their bank accounts. Common forms of lending and financing include credit and charge cards, term loans, revolving lines of credit, cash advances, and invoice factoring. Learn more in our embedded lending + financing guide.

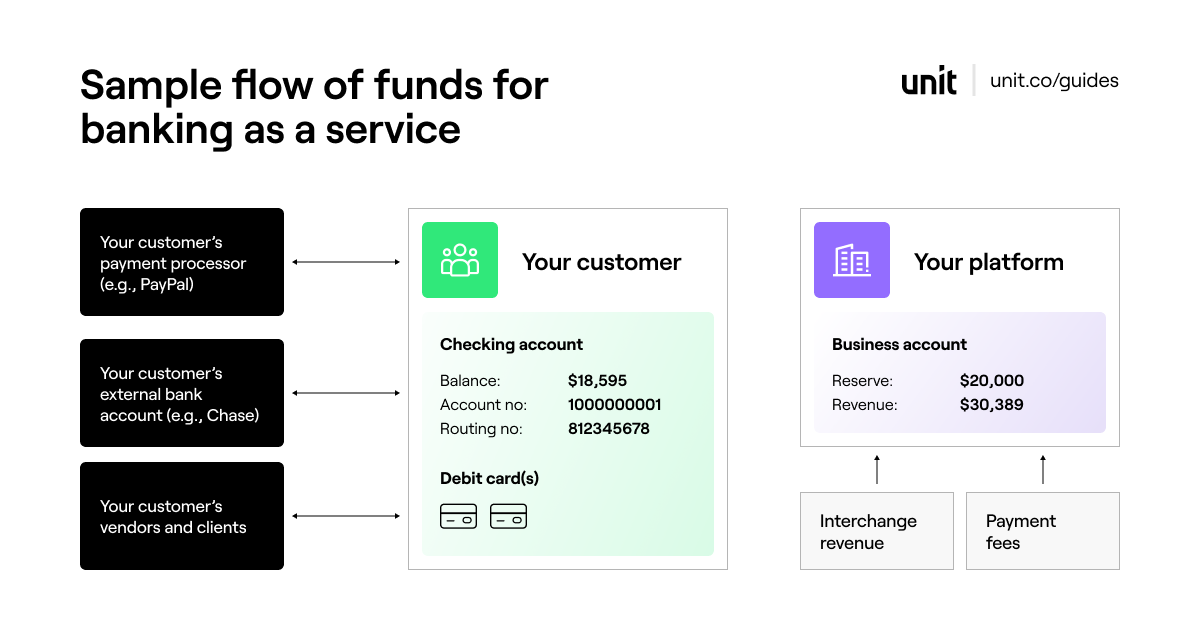

How does banking as a service (BaaS) work?

In this section, we’ll review how tech companies partner with banks to make the banks’ financial products available to their customers.

In general, the tech company maintains a frontend or user interface (UI) that allows their customers to interact with the financial products. When their customers interact with their bank accounts, cards, etc., the tech company passes those instructions along to their bank partner, who executes them.

For example, say a technology startup arranges to pay for a tech subscription using their AngelList Stack account. Although AngelList makes bank accounts and payments available to their customers, they’re not a bank. So AngelList collects those instructions from their customers and passes them along to their bank partner.

The instructions are passed from the tech company to their bank partner using an API (application programming interface). Some banks offer their own APIs, but many banks and tech companies use APIs built and managed by banking as a service platforms.

What are some common use cases for banking as a service (BaaS)?

At Unit, we’ve consulted with hundreds of tech companies. Based on our experience, these are some of the best use cases for banking as a service.

- Vertical SaaS platforms. (Examples: Toast, Flexport). In our recent research with the Harris Poll, we learned that small-business owners often string together 5-6 (or more) different software tools to manage their business finances—and they hate it. If you provide a platform that helps people run their businesses, offering embedded bank accounts can be a great way to address your customers’ pain points, streamline their finances, and become their “financial mission control.”

- Financial apps and services. (Examples: LendingClub, Invoice2go) If you’re already helping your customers manage some aspect of their finances, then embedding banking and other financial products into your product has the potential to “supercharge” your offering. For example, say you help your customers find and apply for financing. If you offered them bank accounts, then you’d be able to see their cash flow, which could help you do a better job of assessing their risk level. As a result, you could help them find more affordable rates and more targeted terms. This is just one example among many.

- Marketplaces and ecommerce platforms. (Examples: Amazon, Shopify) If you’re helping your customers sell things online, they’re likely running their business, at least in part, through your platform. Enabling them to bank with you can help you acquire, engage, and retain customers while generating robust new revenue streams. For example, Shopify now earns more than 60% of its revenue from merchant services, the majority of which are loans to its merchants.

- Payments + payroll providers. (Examples: Square, Gusto). If you’re already moving lots of money for your customers, then embedding financial services into your product can be a great way to help them manage it. For example, 60% of Uber drivers who are eligible for Uber-branded bank accounts have opted in. Many didn’t have bank accounts previously, and many more were willing to make the switch from outside banks in order to gain access to the lower fees + on-demand payouts.

- Banking for underserved groups. (Examples: Globalfy, Catch). Did you know that 15% of small-business owners run their business finances out of a personal bank account? And that 14.1% of US households are underbanked? Technology companies do a great job of meeting customers where they are and making financial services available they might not otherwise have had access to.

But this is hardly a complete list. To get a sense for whether your business is a good fit for embedding financial services, ask yourself the following questions:

- Do we move large amounts of money?

- Are our customers financially underserved?

- Do we have a strong brand and a devoted customer base?

- Do our customers need to get paid faster?

- Do our customers need better financing or access to capital?

- Would having access to financial services improve our customers’ experience with our product?

If you answered yes to any of the above questions, then you may want to investigate partnering with a banking as a service platform to make financial products available to your customers.

What companies use banking as a service (BaaS)?

Ten years ago, just a handful of companies were doing it. In 2021, the transaction value of embedded finance (including BaaS) topped $2.6T, with hundreds of platforms participating.

Further down in this section, we’ve included an image featuring the logos of some of the most prominent companies that have embedded financial services into their platforms. Below, we’ve gone a bit more in-depth on a few of them.

- Invoice2go. Invoice2go started as a tool to help small businesses invoice their customers and get paid faster. Today, they’ve evolved into a platform that helps their customers manage all aspects of their businesses—including their finances. The addition of bank accounts and cards to their platforms enables them to be a one-stop shop for their customers.

- Shopify. Shopify realized that many of their customers (ecommerce merchants) were already using Shopify to run all aspects of their businesses. By making bank accounts available to them, Shopify helps them avoid many of the fees typical of traditional banks and get paid faster. They also help them do their taxes and get rewarded for purchases.

In 2021, the transaction value of embedded finance (including BaaS) topped $2.6T, with hundreds of platforms participating.

- Veryable. Veryable is a platform that connects contract laborers with work opportunities. What sets them apart is their ability to pay their contractors within 24 hours of completing a job—even on holidays and weekends. That wouldn’t be possible without partnering with a banking as a service platform; in fact, Veryable had previously tried four other solutions.

- Toast. Toast provides hardware and software that helps restaurants get paid by diners. When they talked to restaurant owners, Toast realized that many of them couldn’t get the financing they needed to run their businesses. Toast started offering restaurant financing in 2019, and today their lending business generates $14M of revenue per year.

- Gusto. Each month, Gusto helps their small-business customers send millions of paychecks via direct deposit. They realized that many of the people they were helping to pay didn’t have bank accounts—and many more were ready to switch banks for a better experience (faster payments, fewer fees, etc.). Offering bank accounts enables Gusto to keep more money “on their platform;” in other words, they can earn various types of fee revenue from it.

How do companies make money from embedded finance powered by BaaS?

Embedded financial products can be a great way to drive acquisition, engagement, and retention. But what’s most appealing for many companies is the revenue it generates.

There are five ways to make money from embedded banking. If you’re looking for a way to project what that might look like for your company, check out our revenue calculator and full revenue projection tool.

- Interchange fees. These are fees you earn when your customers make purchases with their debit, credit, and charge cards. These card payments typically return between 1.5–3% of every transaction as interchange revenue. Companies typically keep the revenue, return it to their customers in the form of rewards, or some combination thereof. Learn more in our interchange revenue guide.

- Financing revenues. Embedded finance comes in many forms; some of the most common are credit and charge cards, term loans, and revolving lines of credit, cash advances, and invoice factoring. We expect that lending will emerge as a primary source of revenue for tech companies in coming years. To learn more about how you can make money from offering lending products, check out our lending guide.

After they launched embedded financial products powered by banking as a service, Veryable tripled their interchange revenue.

- Deposit fees. In some cases, companies may be eligible to earn fees on the deposits they generate for their bank partner through their marketing efforts.

- Platform fees. These are often overlooked as a source of revenue associated with embedding banking and lending products. Some companies may choose to offer access to their embedded banking products at an extra cost. For example, you may be able to charge a monthly fee for customers who opt into your embedded financial products. Alternatively, you could adopt a “freemium” model, giving customers access to basic financial products for free, then charging a monthly fee for access to more advanced features.

- Payment fees. Using banking as a service, you build many different payment methods into your product; these include ACH, cards, wires, and book transfers. Your customers will expect some kinds of payments (e.g., ACH, transfers between accounts at the same bank) to be free, but it’s possible to charge for others (e.g., wire transfers, push-to-card).

What does it take to launch embedded financial products via banking as a service?

How you approach launching embedded banking will drastically impact the kinds of products you can offer your customers, your time to market, and the amount of resources you need to invest.

If you decide to work without a platform, it could take as long as 2 years; you should also plan on hiring a large dedicated banking team. By contrast, if you decide to work with a banking as a service platform, you could launch in a matter of months, without hiring a large team.

If you decide to go it alone, you’ll need to address the following areas:

- Bank relationship(s). There are more than 4,500 banks in the US. Of those, just a handful have made a name for themselves by effectively partnering with tech companies to offer banking as a service. You’ll likely need to talk to 10 or 20 of them in order to identify just one or two good candidates; plan to spend six months on your search. Learn what to look for in our bank partner guide.

- Compliance. Many founders are shocked by the amount of compliance work required to launch embedded financial products. In many cases, you’ll need to hire a Chief Compliance Officer before a bank will even talk to you. Other weighty compliance obligations include KYC, AML, disputes, PCI-DSS compliance, and third-party risk management. That said, many banking as a service platforms help their customers streamline compliance activities, substantially reducing the necessary investment.

If you decide to work without a platform, launching your embedded financial products could take 2 years.

- Technology. In many cases, partnering with a bank requires building a lot of back-end banking technology yourself. That can include (but is not limited to) maintaining ledgers, issuing cards, handling disputes, connecting to payment networks, calculating interest, generating statements, building a frontend, and maintaining an information security stack to keep your customers’ data safe. Building these things can take up to 18 months. Errors can cost your company millions.

- Capital. As part of making lending and financing options available to your customers, you'll need to figure out where the money to fund the loans and/or financing will come from. For example, if you issue 100 loans of $10k each, the program will require $1m of capital. In general, it will come from one of three sources: 1) your own capital reserves and/or money you’ve raised from investors, 2) your bank partner, or 3) third-party capital. Learn more in our guide to embedded lending and financing.

What should I look for in a BaaS provider?

There are dozens of platforms that claim to offer banking as a service; what they offer varies widely.

For example, some platforms will facilitate an introduction to a bank partner—but from there, the responsibility is all yours. You’ll have to establish the relationship and manage compliance on your own. This can require hiring a large team and committing dozens of work hours each week.

Other banking as a service platforms rely on antiquated financial infrastructure that was built in the 90s (or even earlier). This technology is brittle and often unreliable. In many cases, it won’t support the kinds of products you want to build.

When selecting a BaaS provider, be sure to check on these five areas:

- Relevant experience/ability to execute. The first and most obvious way to diligence a potential banking as a service provider is to tap your network. Ask friends whom they’ve partnered with and how it’s going. Find out which other companies work with a given provider and read their case studies. Or just reach out to a fellow builder on Twitter and ask for a candid assessment.

- Product coverage. You have a good sense of which financial products are a fit for your customers. But not all banking as a service providers support all financial products. For example, some don’t offer virtual cards; others don’t support cash advances. Be specific about what you want and wait for a clear answer. (article continues below)

Some banking as a service platforms rely on technology that was built in the 90s (or even earlier). In many cases, they can't support the kinds of products you want to build.

- Setup costs/time-to-market. With some BaaS providers, launching embedded banking can take 18 months and requires hiring a large team. Others can get the job done in 3 months, for a lower upfront investment. When evaluating a potential partner, ask detailed questions about what you’ll be required to build and what kinds of staff support you’ll need. Ask for a reliable launch timeline and confirm that other companies have done it before.

- Compliance. Making financial products available to your customers comes with weighty compliance obligations, both upfront and on an ongoing basis. Some BaaS providers will help you streamline the process—and others leave it all on your plate. Be sure you are aligned with your potential BaaS partner on important questions like the following: who will be responsible for conducting KYC? Underwriting loans and other financing? Monitoring ACH transactions for suspicious activity? Handling disputes and manual account reviews? Managing audits and periodic re-certifications?

- Economics. Pay attention to pricing, both fixed and at scale. Is there a platform fee? Will you be charged on a per-account basis? What does it cost to process different kinds of payments? What fees will you be able to generate, if any? How will that add to your customer acquisition cost (CAC)? How does it stack up to the revenue you plan to earn?

How do I get started with banking as a service (BaaS)?

Once you’ve decided that partnering with a banking as a service platform is a good fit for your business, we recommend taking these four steps to get started.

- Define your product. First you need to align on exactly which financial products you plan to make available to your customers. As a part of that, you’ll want to create a flow of funds that shows how money flows between bank accounts. You’ll also need to become fluent with the compliance implications of what you’re planning to build. Some embedded financial products are easier to launch; others come with significant complexities.

- Choose an approach to launch it. Now it’s time to decide how you’ll bring your product to market. Working without a platform requires investing considerable resources and can take up to two years. If you choose this route, you will also likely be responsible for compliance and technology on your own. By contrast, working with a banking-as-a-service platform to partner directly with a bank may require a much lighter lift, freeing you to focus on other strategic priorities.

- Plan the economics. Use our interactive calculator to estimate the revenues you expect to make from your embedded financial products. Estimating revenues from lending is more nuanced; but our team would be happy to help you think through it. Once you’ve got your estimated gross revenues, subtract your customer acquisition costs (CAC) and your operational expenses to arrive at your net profits. Learn more in our revenue guide.

- Launch, measure, and iterate. In the past, we’ve seen companies choosing a lighter path to get started, launching with a core set of embedded banking products (e.g., bank accounts, debit cards) and adding on from there. That way, they can establish and deepen a bank relationship, gather valuable data about product performance, validate their financial model, sharpen their underwriting, and otherwise improve their offering over time.

If you’re interested in learning more about how banking as a service can help you become more valuable to your customers and generate robust new revenue streams, contact us to book a demo.

Frequently Asked Questions

How long does it take to launch embedded financial products powered by banking as a service?

That depends on your approach. If you choose to work without a platform, launching embedded financial products can take 2 years. You’ll also have to hire a large banking team.

By contrast, if you work with a banking-as-a-service platform to partner directly with a bank, you can take your embedded financial products to market in just 3 months.

What banking as a service providers are there in the US?

The space is getting increasingly crowded, with dozens of platforms claiming to offer banking-as-a-service. But what they mean by that term—and their ability to deliver on it—varies widely.

Our company, Unit, is the market leader in banking-as-a-service. Others include Bond, Solid, Treasury Prime, Stripe Treasury, Moov, Synctera, and Column.

What’s the difference between BaaS and embedded finance?

The two words are often used interchangeably, but “embedded finance” is the broader and more encompassing term. For example, investments can be a form of embedded finance, but they are not banking-as-a-service. The same is true of insurance.

“Banking-as-a-service” is one approach to embedded finance; it’s a way to “power” your embedded financial features. It applies to those financial services that are typically offered by chartered banks: bank accounts, cards, payments, and lending.

What’s the difference between BaaS and open banking?

Open banking is a broad concept in financial services. It means that companies should be able to digitally access the financial data of consumers and businesses—with their permission, of course—and that consumer and business consumers should have control over their own data. For example, open banking is what enables PayPal to connect your bank accounts so that you can make a payment.

In the US, open banking is often facilitated by financial data aggregators like Plaid and Yodlee; it’s a necessary ingredient of banking-as-a-service. Without open banking, it would be much more difficult for BaaS end-customers to fund their new bank accounts or make payments.

What’s the difference between BaaS and platform banking?

Platform banking is a feature that some chartered banks offer their customers. Under this model, banks make financial services powered by third parties available to their customers via their app or website. For example, a bank might offer loans underwritten by Upstart, or they might offer an automated savings tool powered by Acorns. It’s a way for financial institutions to expand their product offering without having to build from scratch.

What are some examples of banking as a service in use?

With banking as a service, leading companies can solve problems for their customers that aren’t easily addressed by traditional banks. Here are just a few examples:

- Shopify helps merchants get paid faster. In 2020, Shopify launched “Shopify Balance,” a suite of financial services for their merchants. Today, Shopify earns more than 73% of their revenue from merchant solutions, the vast majority of which are embedded financial products.

- Toast provides access to loans. You’ve probably seen the Toast logo when paying your bill at a restaurant. They launched Toast Capital to help restaurants access fast, flexible loans—as soon as the next business day.

- Roofstock organizes rental property finances. For landlords, managing rental-property finances can be a huge headache, requiring 6-8 different software tools. Roofstock solves this by offering bank accounts—automating routine tasks and bringing everything into one place.

- Flexport offers flexible financing. Flexport provides the digital infrastructure needed to move freight across the globe. They offer embedded lending for importers and exporters, including invoice factoring and revolving lines of credit. It’s a big differentiator for them.

- Mindbody simplifies payments. More than half of Mindbody’s revenue comes from embedded payments. Recently, they launched cash advances based on sales history. MindBody has a direct line of sight into their client’s sales performance, enabling them to offer affordable rates.